“New listings in the market were also slightly higher than what was available over the past two months, which is providing more options to purchasers.”

January’s new listings were 2,246 relative to the 1,208 sales in the market, causing inventories to edge up over December levels. These types of movements are typical for January, but 2021 is starting the year with 4,035 units in inventory. This is far lower than the past six years.

Benchmark prices remained at levels relatively consistent with prices recorded at the end of 2020, but they reflect a year-over-year gain just below two per cent.

Average and median prices recorded higher year-over-year gains, likely due to larger gains in sales in the higher end of the market. Those segments do not have the same inventory constraints as lower-priced product.

Housing Market Facts

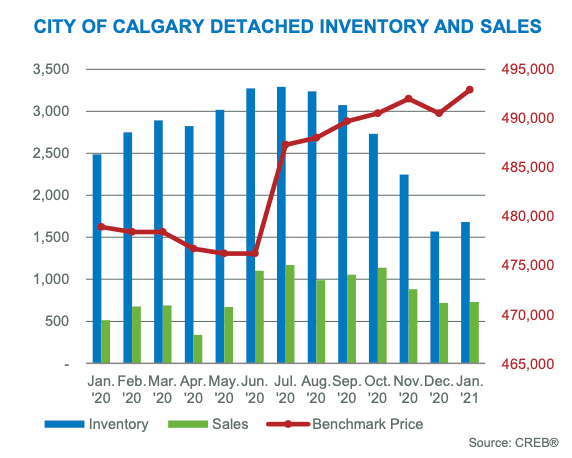

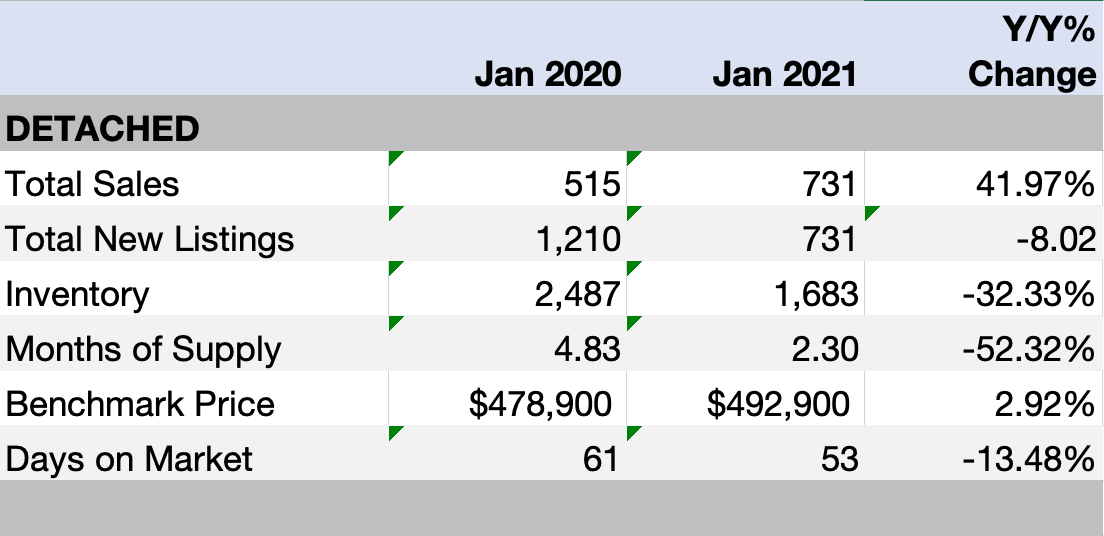

DETACHED - Detached sales improved across every price range this month, but the lack of choice in the lower price ranges likely placed limits on the gains in sales.

New listings did rise, but it was not enough to prevent further tightening in the market, as the sales-to-new-listings ratio rose to 71 per cent and the months of supply fell to under two months. This is the lowest months of supply recorded in February since 2007.

Tighter market conditions occurred across all price ranges, but properties priced below $600,000 saw the months of supply fall to just above one month. These conditions are supporting significant price gains in the detached sector, which recorded a February benchmark price of $502,500. This is nearly two per cent higher than last month and five per cent higher than last year.

It is also the first time since 2018 detached prices have risen above $500,000, and currently sits under five per cent below previous highs recorded in 2014.

Prices increased compared to last month and last year in every district of the city. However, the magnitude of those increases varied, with the largest year-over-year gains occurring in the South East district at nine per cent, and the lowest gains occurring in the City Centre at under two per cent.

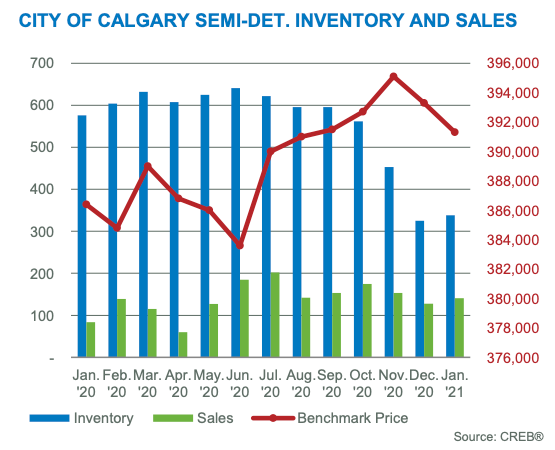

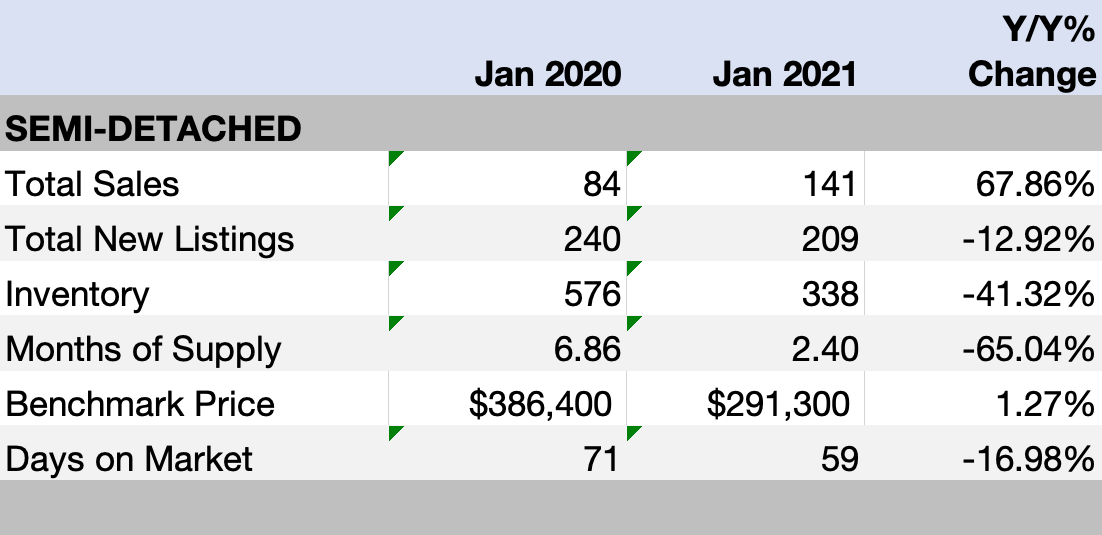

SEMI-DETACHED - Semi-detached sales in February recorded significant gains, pushing sales activity to the highest February levels seen in nearly 13 years. However, like the detached sector, the improvements in new listings were not enough to offset sales, ensuring this sector continues to favour the seller.

With lower levels of supply relative to sales, benchmark prices improved over both last year and last month. However, this was not consistent across all districts.

The West district continues to see prices that remain over two per cent lower than last year’s levels. The strongest year-over-year price gains were reported in the South East and North districts.

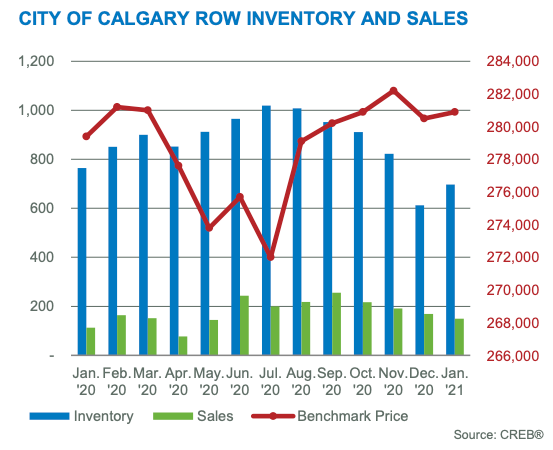

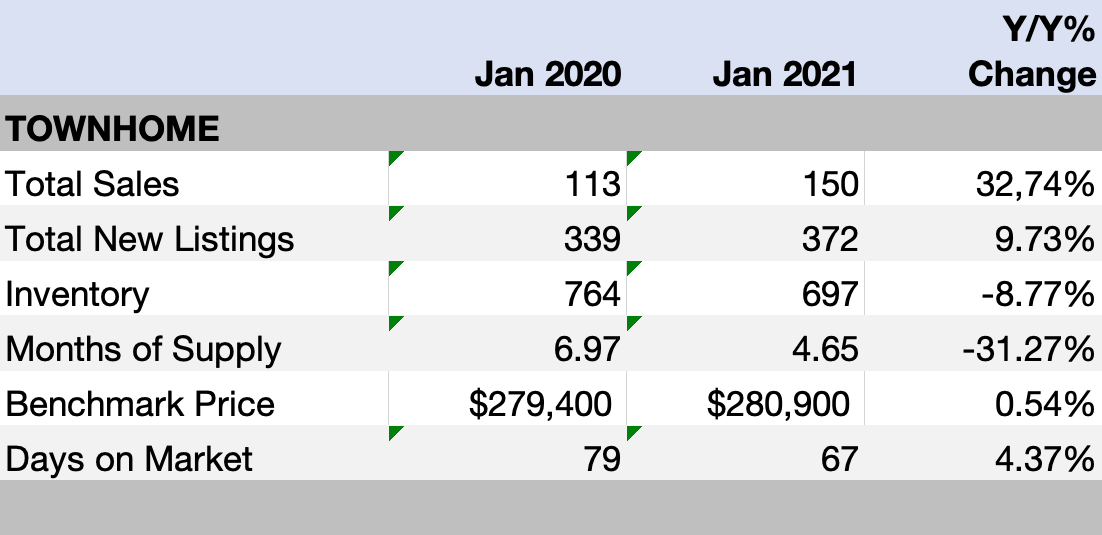

ROW - Despite a significant increase in new listings, improving sales offset the gains and the months of supply fell to three months.

Conditions for row properties are not as tight as what we have seen in both the detached and semi-detached sectors. However, they do reflect an improvement relative to the oversupplied conditions recorded last year. However, when considering activity by price range, pockets of oversupply persist in this market.

Citywide reductions in inventory relative to sales supported some price improvements in this segment. The benchmark price trended up from last month and currently sits just over one per cent higher than last year’s levels. Year-over-year gains did not occur across all districts, as prices remain lower than last year’s levels in the North, North West, South and South East districts.

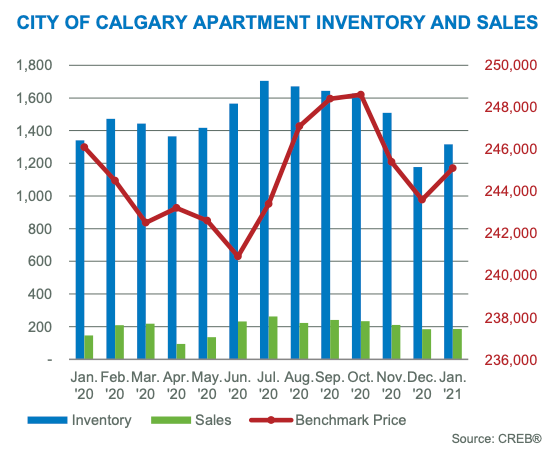

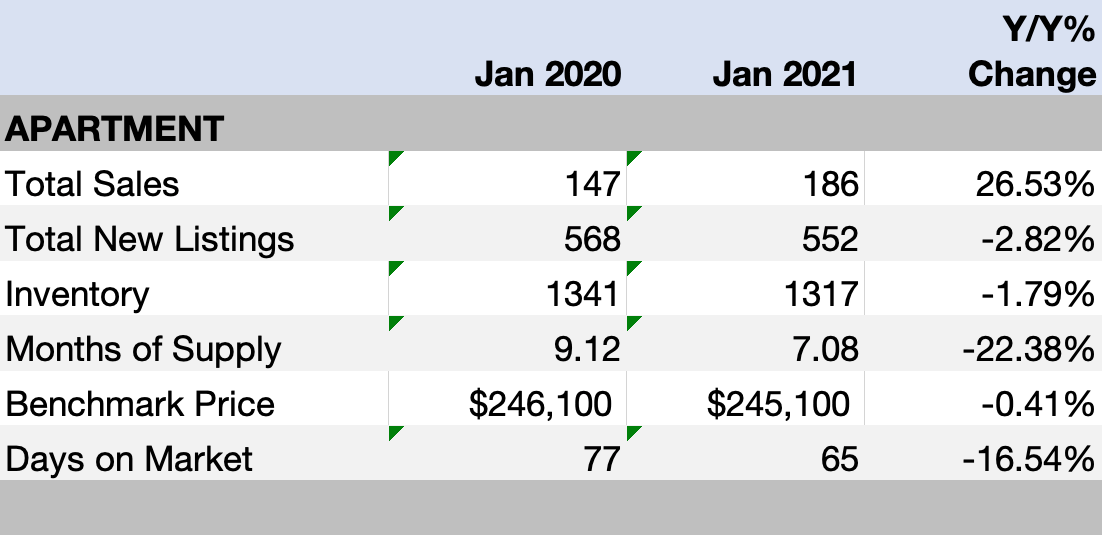

APARTMENT CONDOMINIUM - Driven by product priced mostly under $300,000, apartment condominium sales improved to best February levels recorded over the past six years.

However, the gain in sales was not enough to cause any significant changes in inventory levels. February inventory remained elevated compared to levels we typically see at this time of year.

While the months of supply has trended down in this sector, it remains above five months. This is preventing the same type of price recovery seen in other sectors. On a year-to-date basis, the benchmark price remains similar to levels recorded last year.

Detached Sector

Semi-Detached Sector

Townhome (Row) Sector

Apartment Condominium Sector