The growth in new listings in 2022 was not enough to offset the gains in sales, and supply levels have remained low, especially for lower-priced product. The higher lending rates are also expected to weigh on listings growth in 2023 as it has become more challenging for a move-up buyer. While improved starts are expected to help support supply growth, thanks to the strong migration levels, supply levels are not expected to report significant gains.

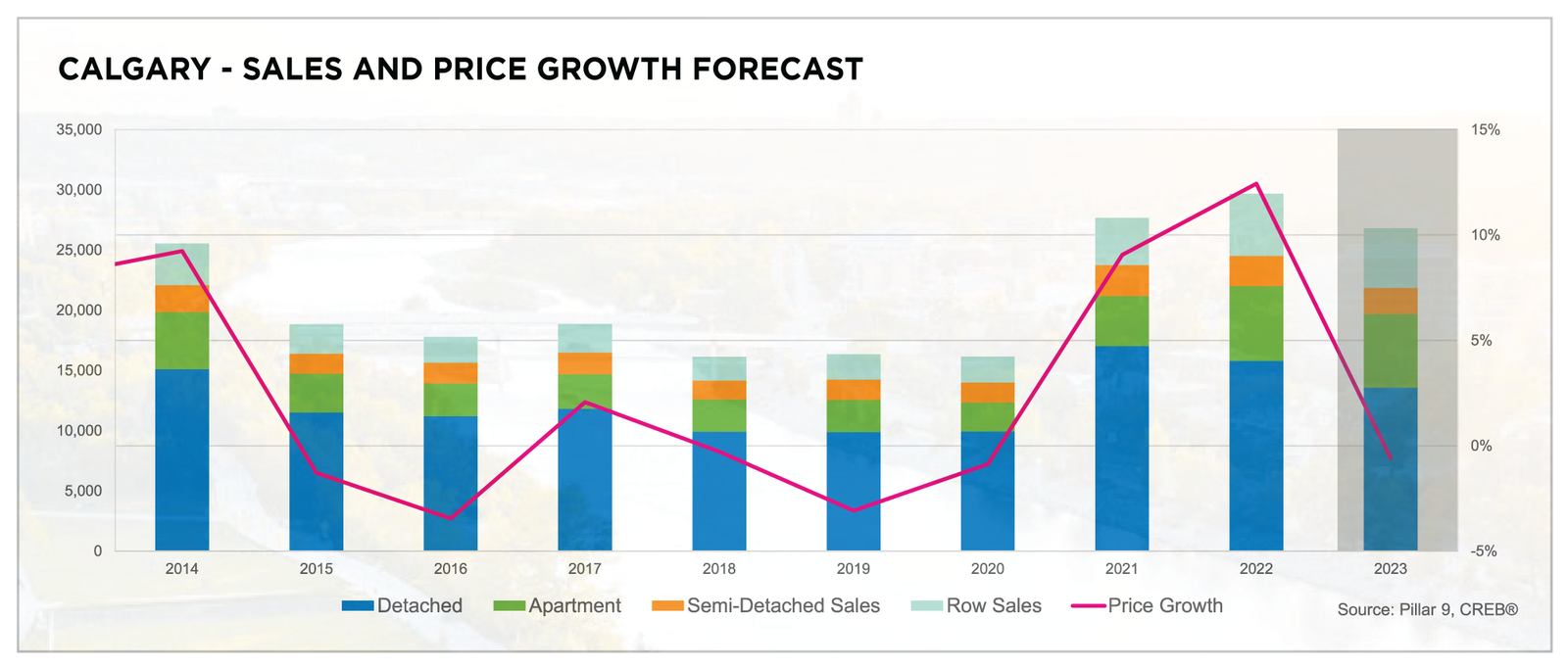

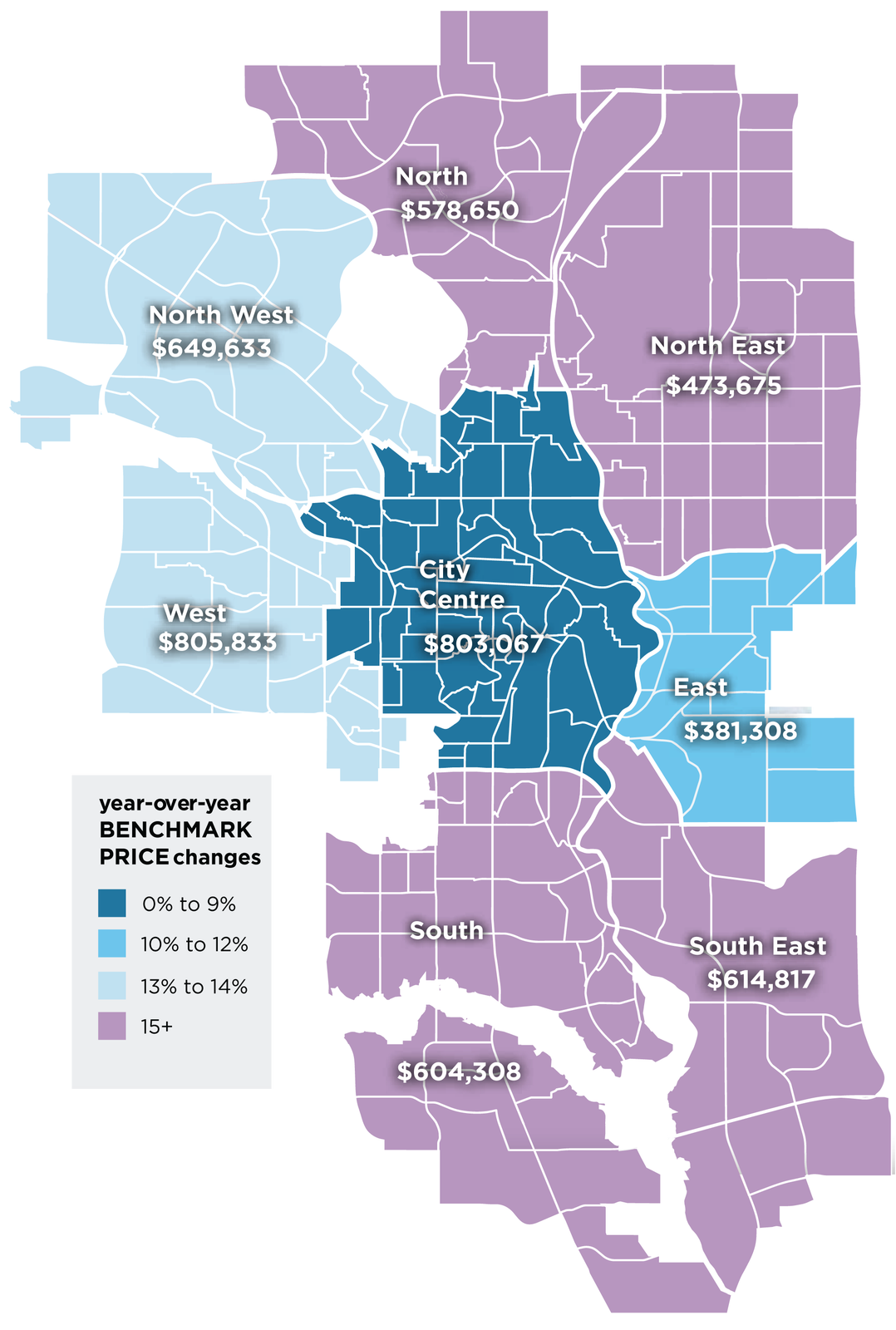

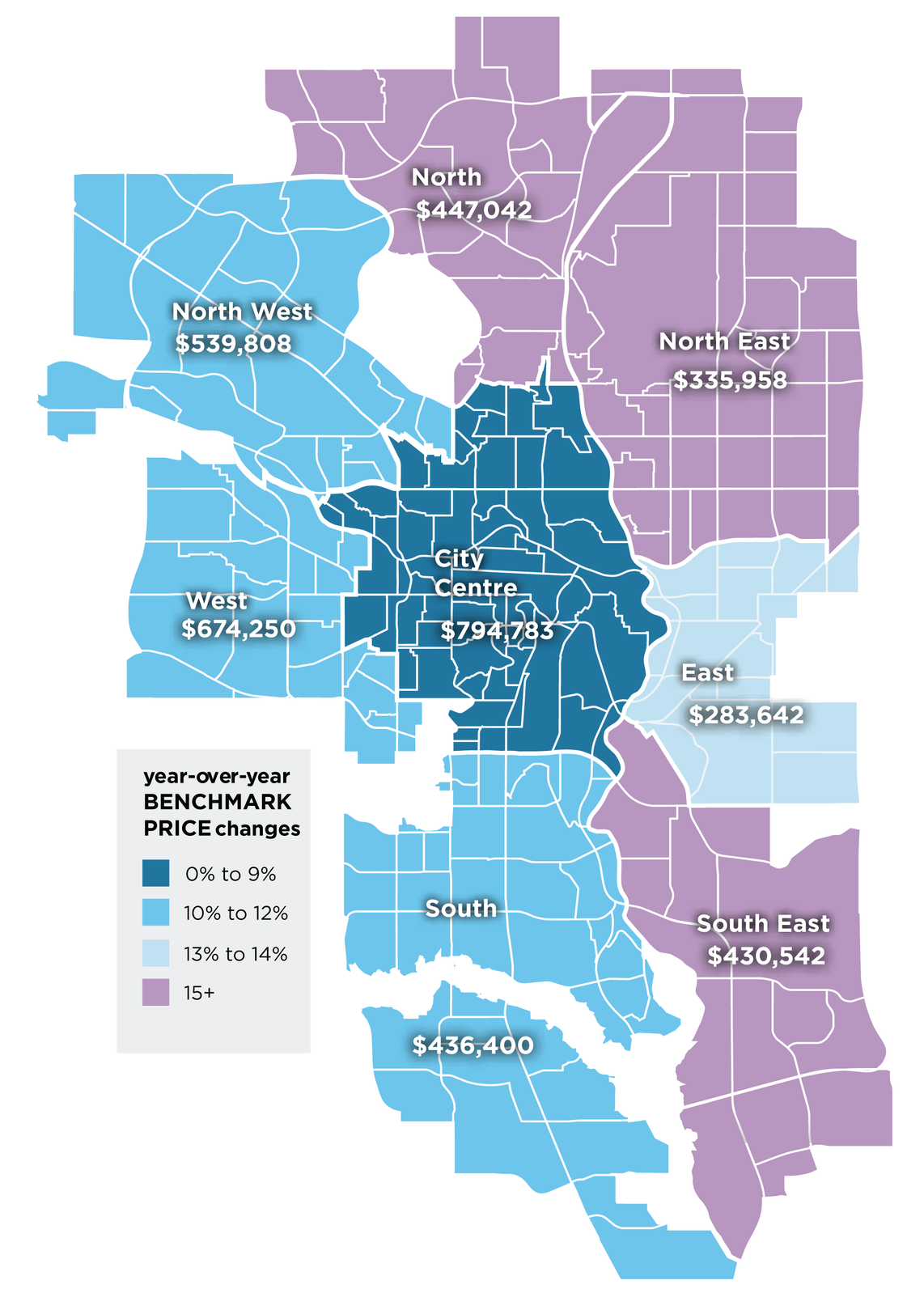

The low starting point and limited upward pressure on supply in 2023 are expected to prevent any significant downward pressure on prices as demand normalizes. However, conditions are expected to vary depending on price range and property type. Higher-priced homes are expected to see some downward price pressure as that segment of the market is not experiencing the same supply constraints. Meanwhile, supply declines relative to sales for lower-priced properties are expected to continue to support modest price growth. Declines in the upper end of the market are expected to offset gains in the lower end of the market, as total residential prices in Calgary are expected to stabilize in 2023.

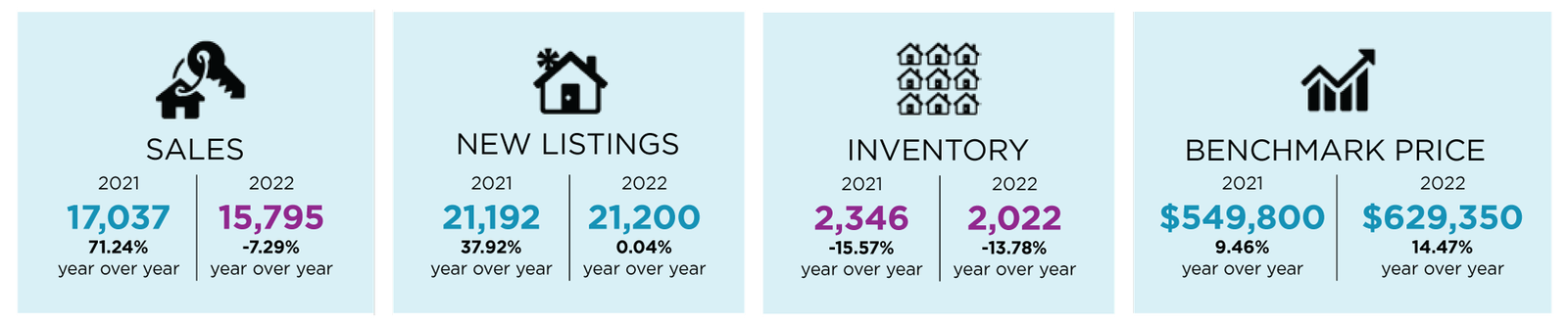

CALGARY RESALE MARKET IN 2022

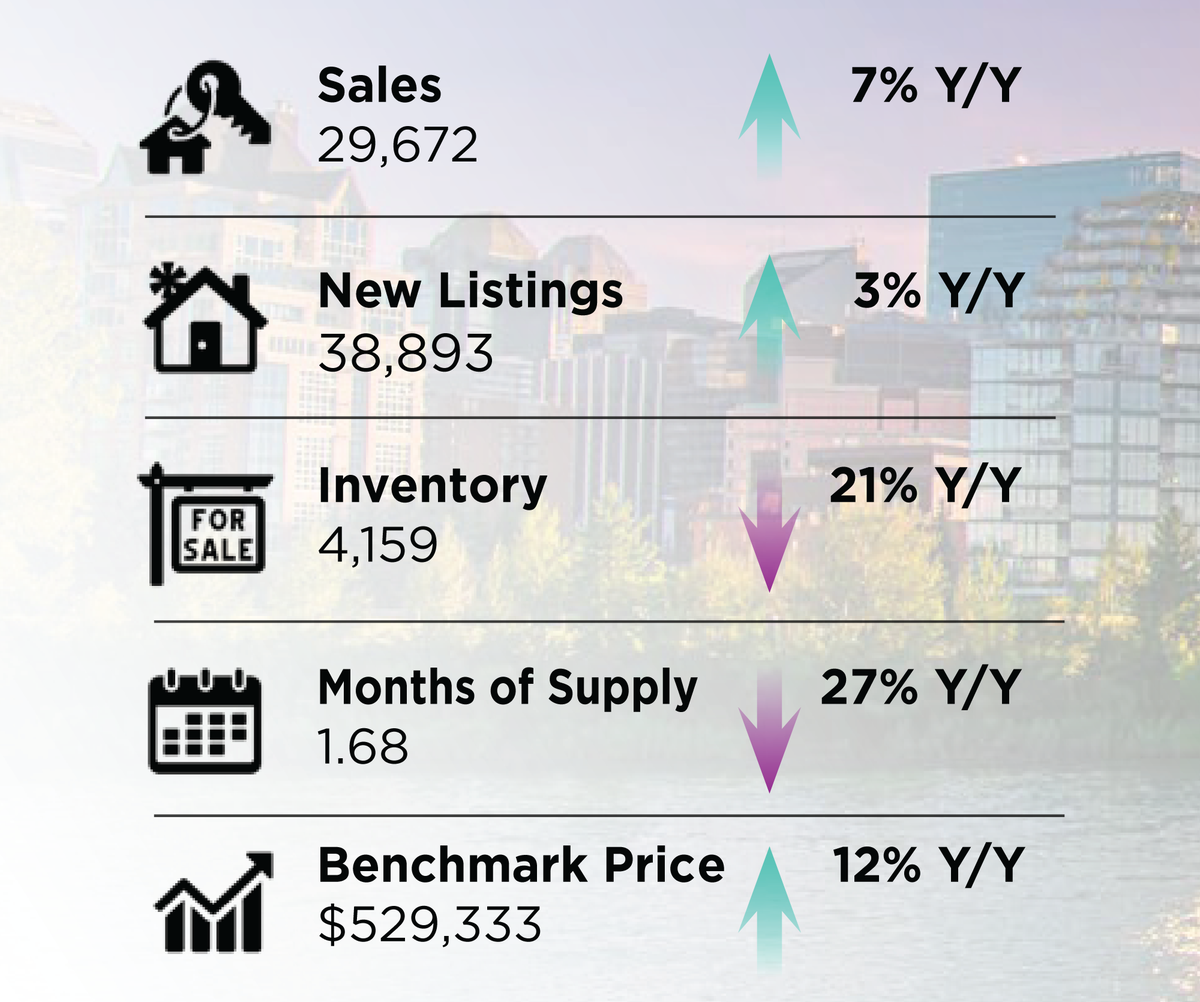

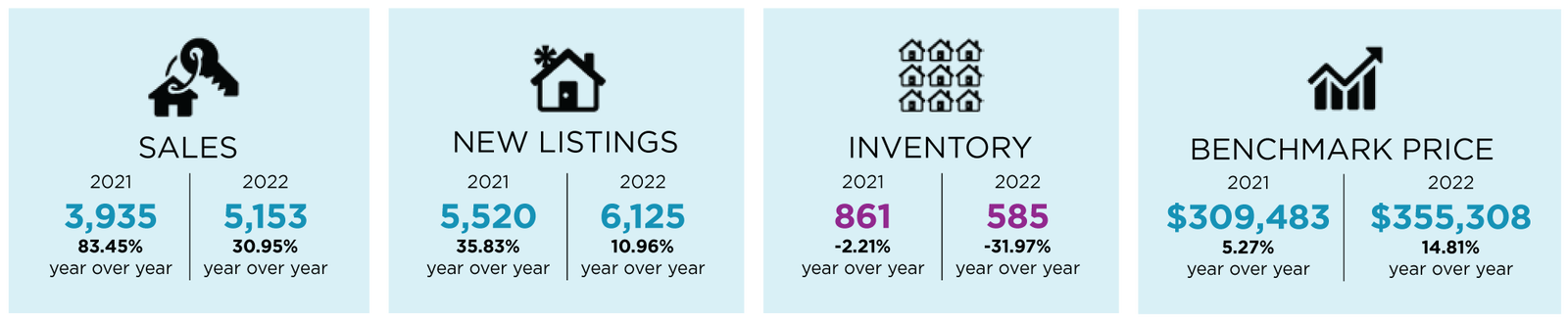

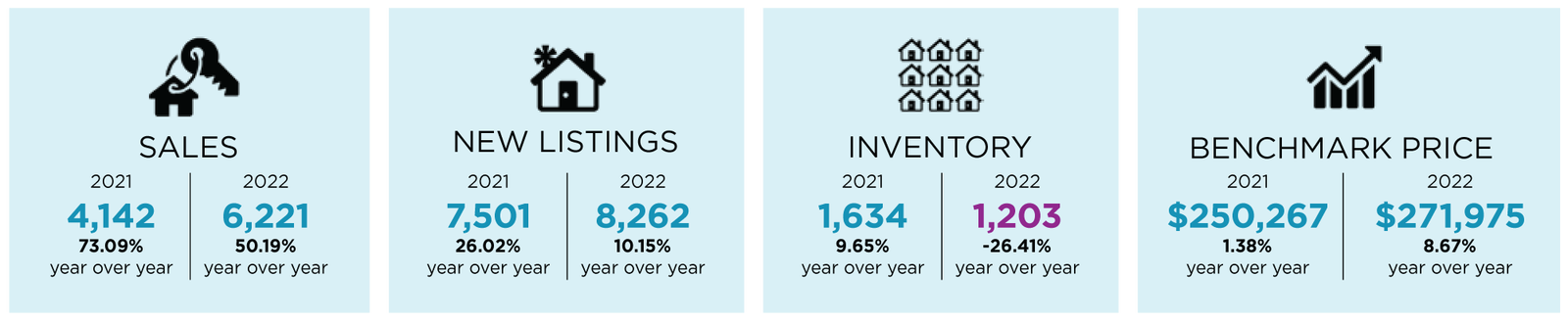

In 2022, sales activity was expected to be strong in the spring and slower in the second half of the year following rate gains. What was unexpected was the record high levels of sales achieved earlier in the year, resulting in a record year for sales.The anticipated rise in lending rates caused a surge in sales over the first quarter of 2022. Conditions in the city started to shift by June after the third consecutive rate gain, and steep price gains caused sales to slow in the detached sector. Thanks to strong growth for row and apartment properties, city-wide sales reached record levels in 2022. At the same time, the growth in new listings in 2022 was not enough to offset the gains in sales and supply levels have remained low, especially for lower-priced product.

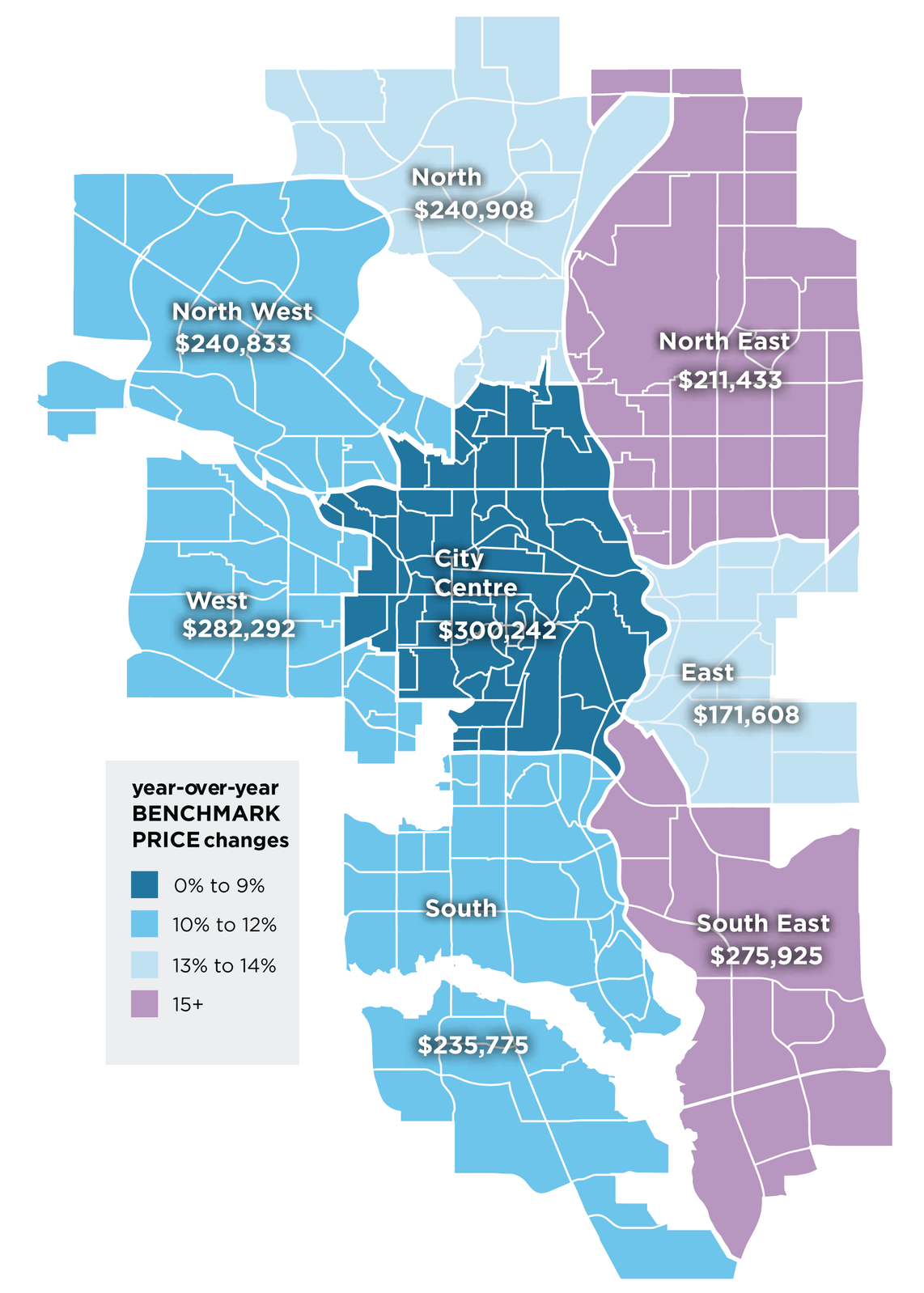

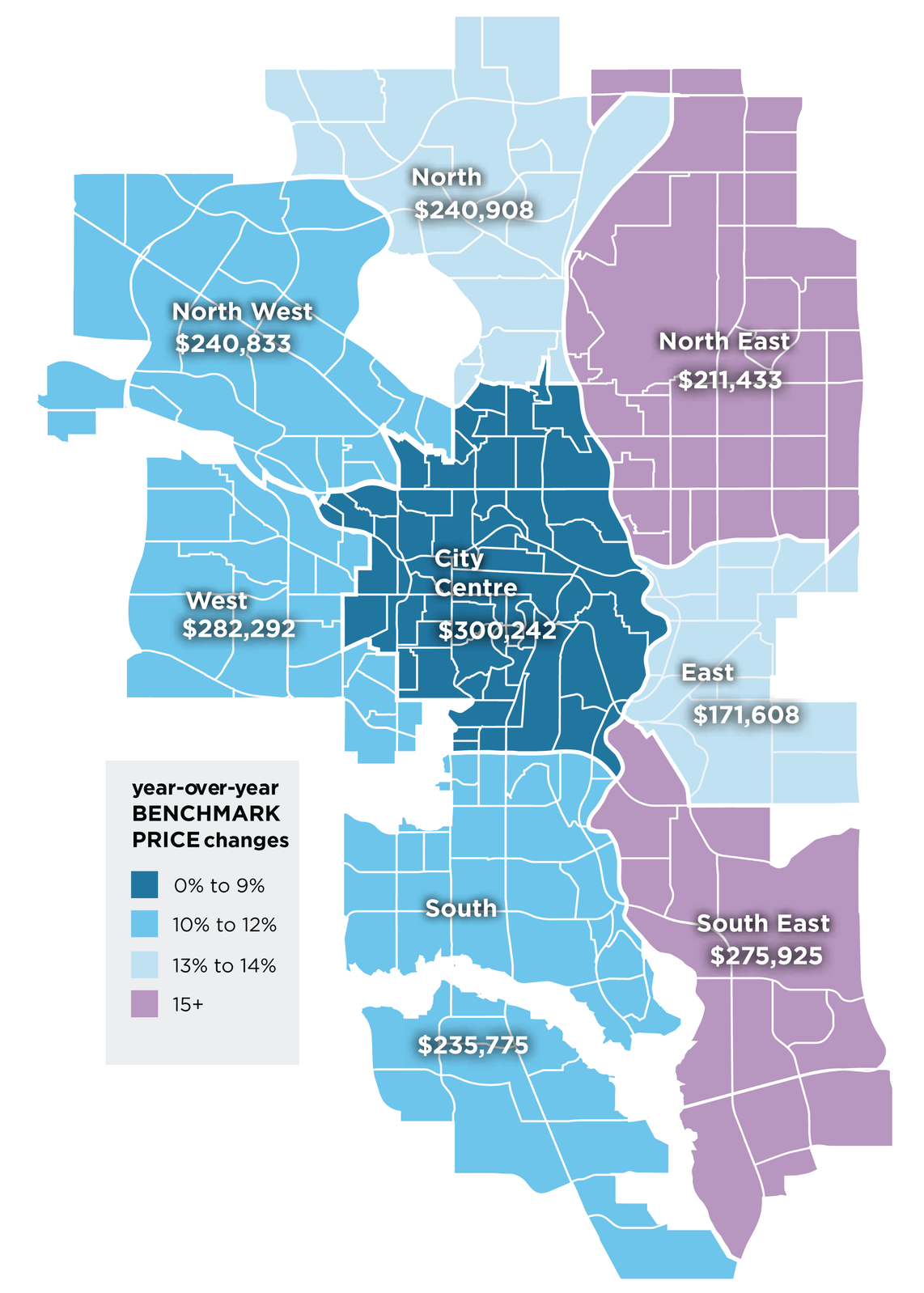

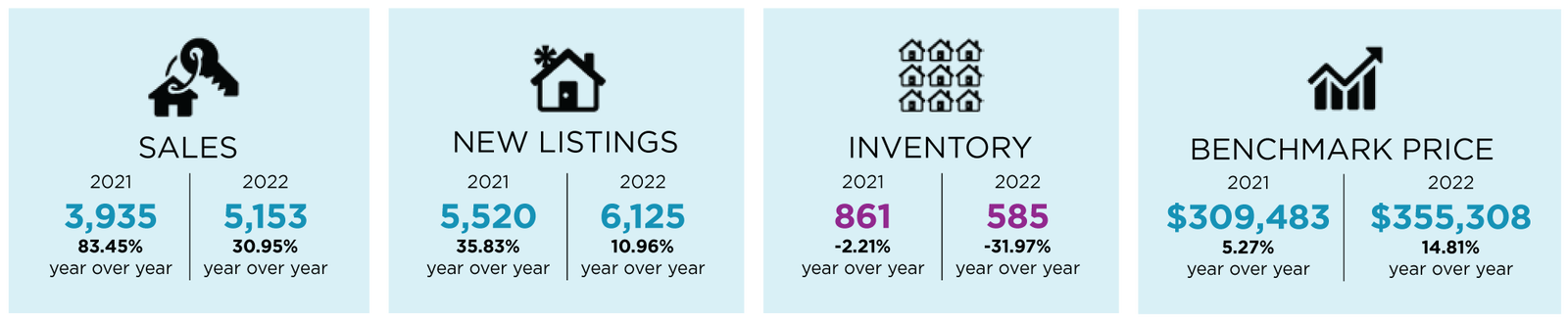

Prices rose by over 14 percent from the end of 2021 to the peak in May 2022, as sales growth far exceeded the additions to supply. From the peak in May to the end of 2022, prices declined, but not enough to offset the earlier gains as annual benchmark prices rose by 12 percent.

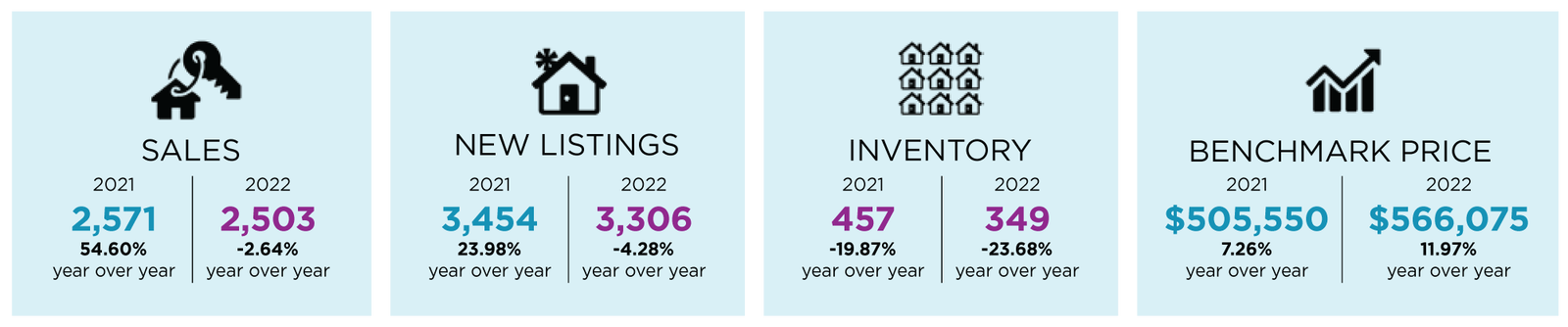

HOUSING MARKET - DETACHED

Detached home sales saw a steep rise early in 2022, with significant pullbacks later in the year. The main difference is the declines later in the year offset earlier gains, and annual sales fell by seven percent. While higher lending rates did impact sales activity, the decline was driven by easing sales in the lower price ranges. The sharp decline in new listings for homes priced below $500,000 provided limited options for potential purchasers looking for affordable detached homes restricting the sales in those ranges. While annual sales did grow in the higher price points by the end of the year, further rate gains did dampen activity in the upper price ranges as well.While conditions were tight across all price ranges throughout the spring, supply gains later in the year were limited to the upper price ranges resulting in divergent conditions that were dependent on price. By the end of 2022, the result was persistent sellers’ market conditions for lower-price detached homes and balanced conditions in the upper price ranges. Overall recent price adjustments did not offset the earlier gains, and annual prices remained 14 percent higher than 2021.

As we move into 2023. we anticipate that supply levels will remain relatively low for affordable product as higher lending rates will prevent more move-up opportunities for some buyers and prevent sales growth in this category. At the same time, much of the new construction tends to be targeted at the higher price ranges limiting the options for consumers in the lower price ranges. However, supply levels are expected to rise in the higher price ranges relative to demand which will cause some downward pressure on home prices, outweighing any gains that may still be occurring in the lower price ranges. Overall, detached home prices are expected to ease by less than two percent.

HOUSING MARKET - SEMI-DETACHED

Earlier gains were offset by pullbacks later in the year, leaving annual sales just slightly below last year’s record level. While sales did ease in 2022, some of this was related to a significant drop in new listings leaving limited choice for prospective buyers looking for more affordable product. Overall, the months of supply did improve in the later part of the year but remained low relative to historical levels. The persistently tight conditions did support annual benchmark price gains of 12 percent.

As we move into 2023, sales activity is expected to ease relative to the high levels achieved over the past two years but remain stronger than activity reported before the pandemic as purchasers continue to seek out more affordable options in the market. At the same time, additional supply options coming from the new home market will add choice to the market. Supply gains are expected to help support more balanced conditions and take some of the pressure off prices, which are expected to stabilize in 2023.

HOUSING MARKET - ROW

With a shift toward more affordable housing options, row sale activity hit a new record high in 2022. Earlier in the year, new listing growth helped support stronger sales. However, like other property types, pullbacks in new listings occurred in the later part of the year, causing inventory levels to drop to some of the lowest levels seen in nearly a decade. The persistently tight market conditions supported an annual price gain of nearly 15 percent.

Higher lending rates will continue to draw purchasers to this segment of the market, but supply levels will likely remain relatively low in 2023 compared to sales, preventing any significant adjustment in prices. While we do not anticipate prices to ease in this sector, the pace of growth is expected to slow to under one percent.

HOUSING MARKET - APARTMENT

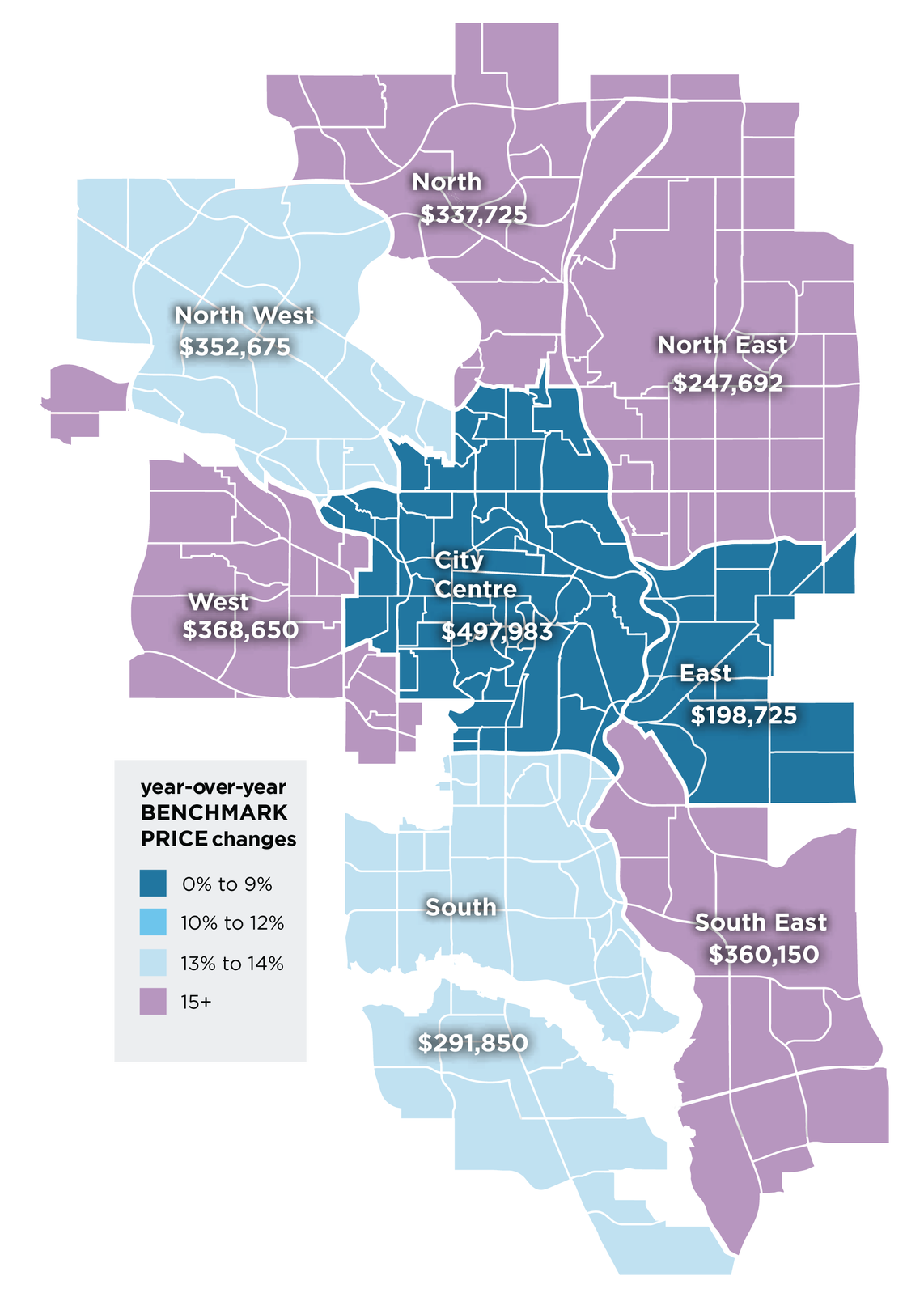

Shifts in the apartment condominium sector took longer than other property types as this segment has struggled with excess supply for many years. In 2022, sales activity was higher than the previous year in every month, contributing to a new record-high year for sales. Demand was partly driven by those looking for affordable options in the housing market. At the same time. rising rental rates are also thought to have increased condominium ownership demand from investors. The surge in sales in 2022 was only possible due to the level of new listings available for this property class. While the growth in new listings helped support the sales, the growth in sales outstripped the addition of new listings and inventories eased, as did the months of supply. The tighter market conditions supported price growth, as the annual benchmark price rose by nearly nine percent in 2022.

Rising prices, combined with higher lending rates, are expected to cool sales activity in 2023. However, the relative affordability of apartment condominiums and rising rental rates are expected to keep ownership sales for apartment condominiums above long-term trends. While some supply relief is likely to come through the new home market, it still will take several months before the market shifts into more balanced territory. While there could still be some price adjustments, overall benchmark prices are expected to start to stabilize this year, supporting a modest annual growth of one percent.