In a market that continues to show resilience, May saw a total of 3,092 resale home sales. While this figure is nearly one percent below last year's record high, it is 34 percent higher than long-term trends for the month. The pullback in sales was primarily driven by declines in lower-priced detached and semi-detached homes, where there was limited supply choice compared to last year.

"Although new listings have increased, much of this growth is in higher price ranges for each property type," said Ann-Marie Lurie, Chief Economist at CREB®. “Our strong economic situation has supported sales growth in these higher price ranges. However, this month's sales could not offset the declines in the lower price ranges due to a lack of supply choice."

New listings in May reached 4,333 units, almost 19 percent higher than last year. This increase in new listings compared to sales caused the sales-to-new listings ratio to drop to 71 percent, supporting a modest year-over-year inventory gain. Despite this, inventory levels remained nearly half what we typically see in May, with most gains driven by homes priced above $700,000.

While inventories did improve this month, conditions continue to favour sellers with one month of supply. Several districts continue to report less than one month of supply, while the City Centre reported the highest supply-to-sales ratio at one and a half months. Seller market conditions drove price growth across all districts in the city. The unadjusted total residential benchmark price in May reached $605,300, nearly one percent higher than last month and 10 percent higher than last May.

Housing Market Facts

DETACHED SECTOR

The gain in detached sales for homes priced over $700,000 was not enough to offset pullbacks across the lower price ranges, as year-over-year sales declined by seven percent. At the same time, new listings rose enough to cause the sales-to-new-listings ratio to drop to 68 percent, supporting inventory growth. However, inventory levels for homes priced below $600,000 continued to fall, accounting for only 13 percent of the detached market.

With just over one month of supply, the detached market continues to favour the seller, and prices continue to rise. As of May, the unadjusted benchmark price reached $761,800, over one percent higher than last month and 13 percent higher than prices reported last year. Prices improved across all districts, with the most significant year-over-year gains occurring in the most affordable districts.

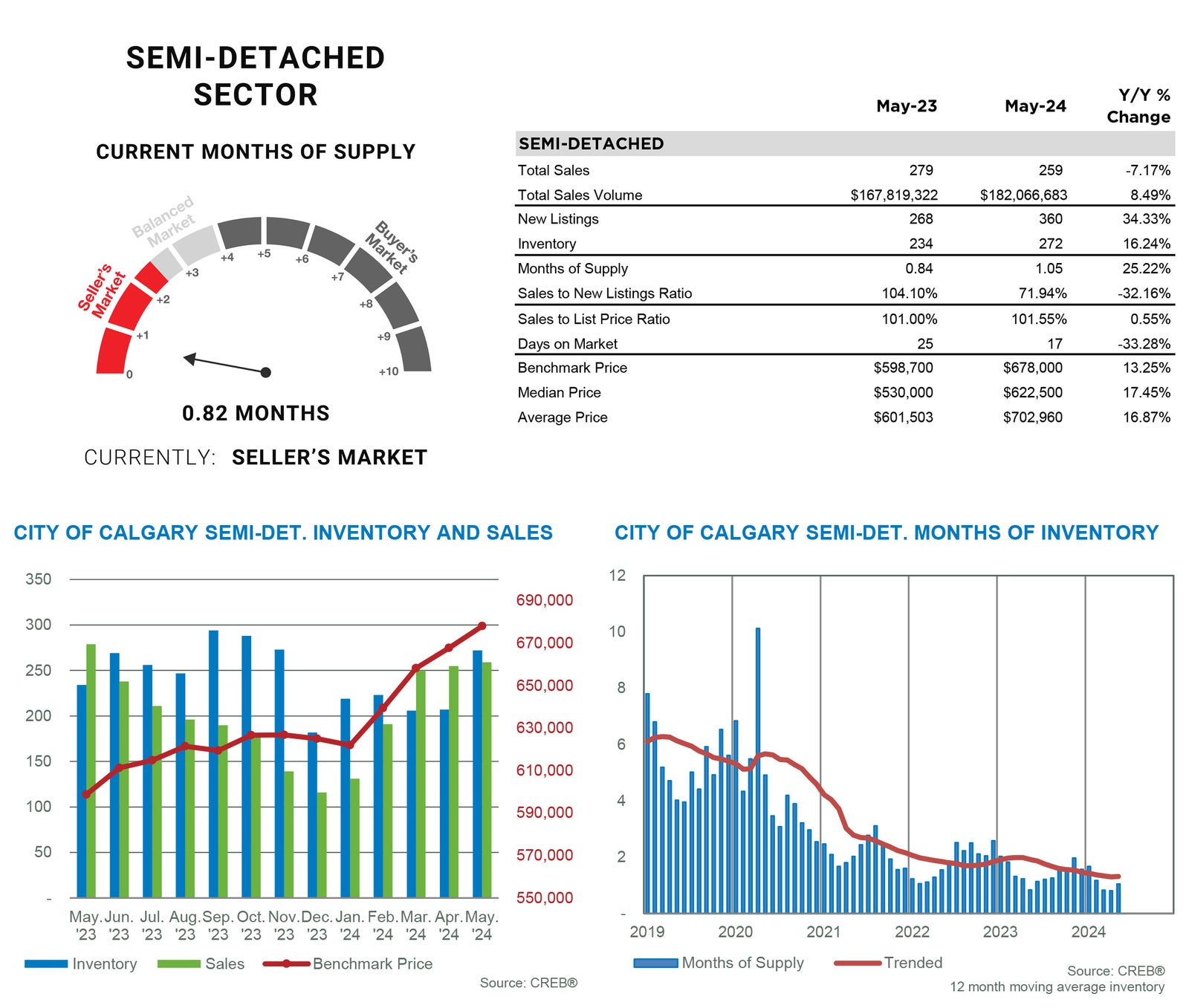

SEMI-DETACHED SECTOR

The year-over-year decline in sales did not offset earlier gains, as year-to-date sales rose by nearly 11 percent. Like the detached sector, we have also seen improved levels of new listings come onto the market, causing the sales-to-new listings ratio to drop to 72 percent and driving some gains in inventory levels.

Nonetheless, the market continues to favour the seller with one month of supply. The persistently tight market conditions continue to drive up prices. The benchmark price reached $678,000 in May, over one percent higher than last month and 13 percent higher than last May.

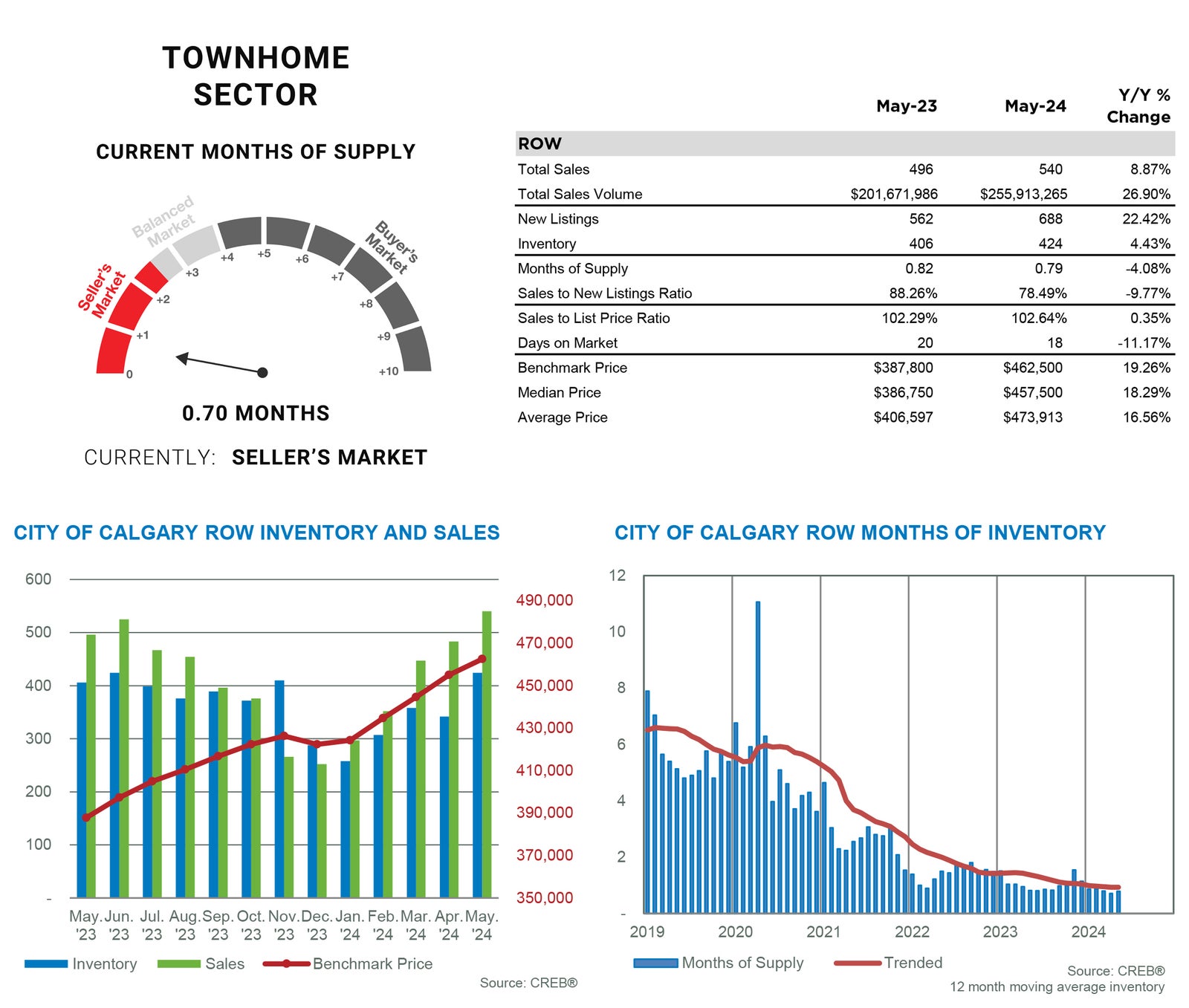

TOWNHOME/ROW SECTOR

May reported 540 sales, a gain over last year that has contributed to the 16 percent year-to-date rise. At the same time, new listings also rose, supporting a gain in inventory levels. Inventory levels have declined for properties below $400,000, but the gains reported for higher-priced row properties were enough to support overall inventory gains.

With a sales-to-new-listings ratio of 78 percent and a month of supply below one month, conditions continue to favour the seller, driving further price growth. In May, the benchmark price reached $462,500, nearly two percent higher than last month and over 19 percent higher than last year’s levels.

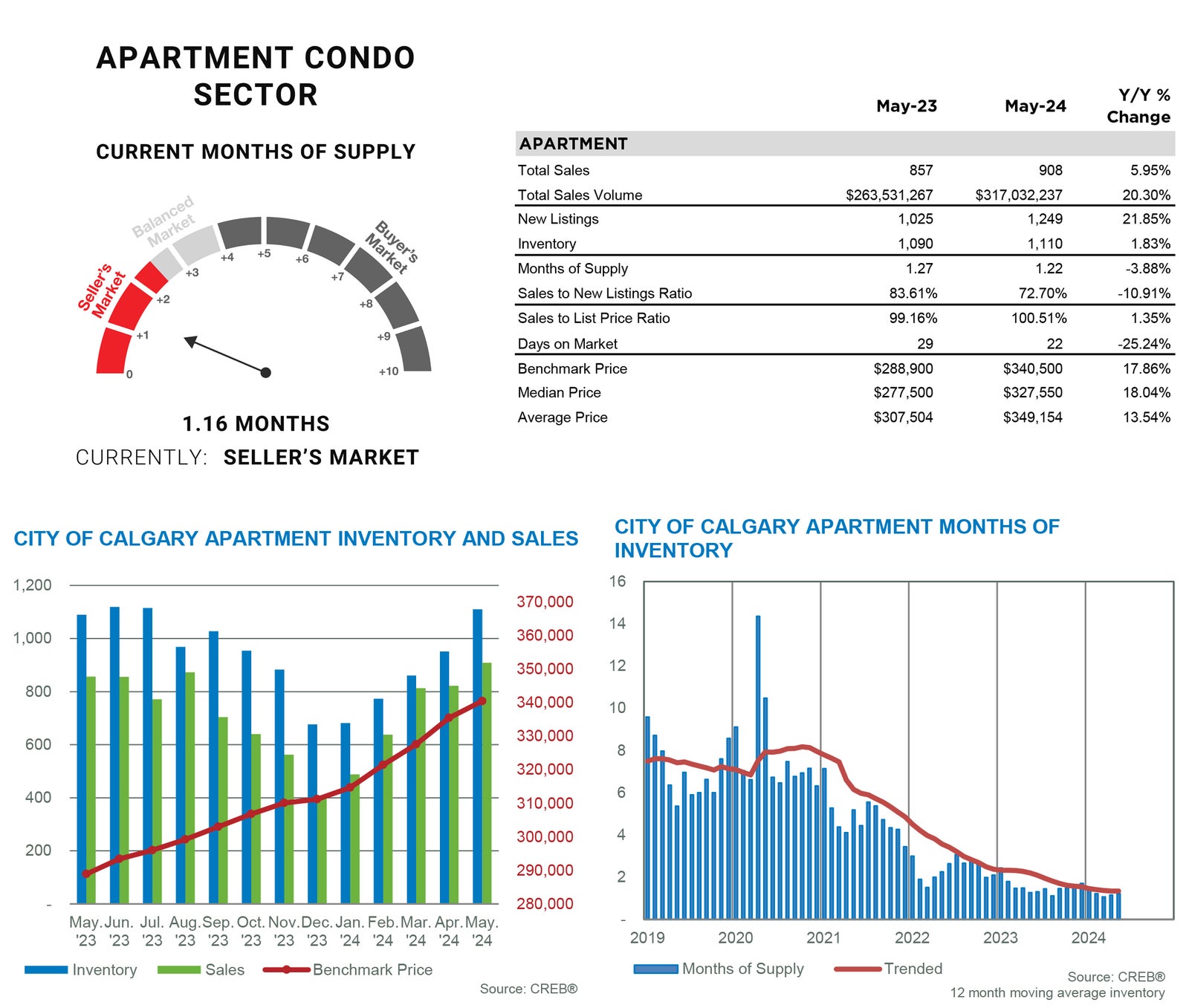

APARTMENT SECTOR

Demand for affordable homes continues to drive growth for apartment condominium-style homes. May sales continued to rise, contributing to the year-to-date record high with a 19 percent gain. This was partly possible thanks to gains in new listings preventing a further drop in inventory levels. While inventory levels are similar to last year, the gains for products over $300,000 offset the steep declines for lower-priced homes.

With a supply of just over one month, conditions still favour the seller, and prices continued to increase compared to last month's and last year’s levels. Year-over-year price gains exceeded 30 percent in the North East and East districts, with the lowest price growth occurring in the City Centre at 13 percent.