City of Calgary, May 24, 2024 - Calgary’s housing market remains a hot spot in the country, driven by record-high international and interprovincial migration over the past two years. This influx has significantly increased housing demand. Employment gains and relative affordability continue to attract people to the province, resulting in strong

sales growth despite the high-interest rate environment. The higher interest rates have shifted the market, with more

consumers seeking relatively more affordable housing options. As of the first quarter of 2024, detached home sales account for only 44 percent of all sales, a notable decrease from nearly 60 percent two years ago. This shift is also due to a lack of lower-priced detached homes, with almost 70 percent of the available inventory priced above $700,000.

Despite record-high housing starts last year and an increase in new listings in the resale market, supply struggles to keep up with demand. Sales activity rose across all property types and would have increased further if more supply options were available. Although new listings did rise, they were insufficient to match the sales growth, causing inventories to fall compared to the previous quarter and last year. Inventory levels are among the lowest ever reported, about half of traditional market levels, with the most significant declines in lower-priced homes. This has reduced the months of supply to one month, making the start of 2024 even tighter than last year.

Calgary has experienced seller’s market conditions since the end of 2021, driving price recovery and further gains over the past few years. With the low supply environment persisting, price growth is exceeding expectations. In the first quarter, the total residential benchmark price increased by over two percent compared to the previous quarter and is now more than 10 percent higher than last year. The most significant quarterly gains were seen in the detached and apartment sectors, exceeding three percent, with year-over-year gains ranging from 13 percent in the detached and semi-detached sectors to over 18 percent for row and apartment-style homes.

Although there are signs of slowing employment gains, previous gains in higher-paid industries and the influx of migrants have created pent-up demand. Many potential buyers have been sidelined due to limited supply or being outbid. The increase in new listings and rising new home activity can help provide the needed supply, but it will take time for the market to shift out of the current seller’s conditions, continuing to drive price growth this year.

ECONOMIC UPDATE

Source: CREB®

HOUSING MARKET

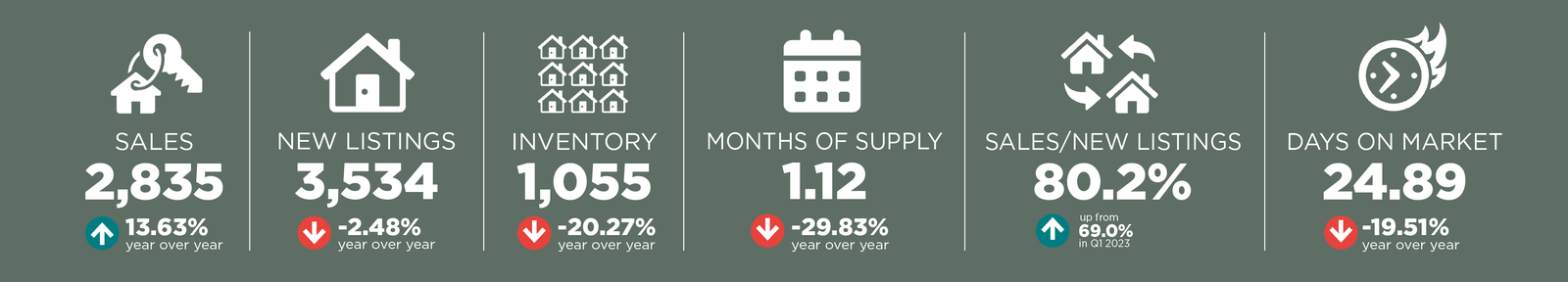

Detached

Sales improved relative to the new listings coming onto the market, causing a further decline in inventory levels and keeping the market firmly in seller’s market conditions. Most of the supply decline occurred for homes priced under $600,000. Limited supply choice for affordable products drove people to higher-density homes, and the share of sales dropped to 44 percent.

Source: CREB®

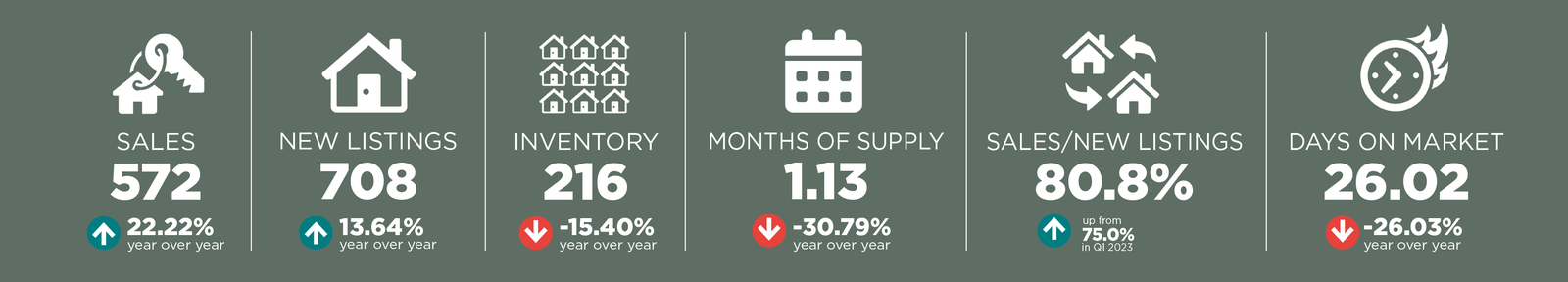

Semi-Detached

The gain in new listings was not enough to offset the growth in sales, resulting in further inventory declines, keeping the market firmly in the seller’s market territory. Like the detached sector, the biggest challenge was in the lower price ranges, where inventory has dropped significantly over the past two years.

Source: CREB®

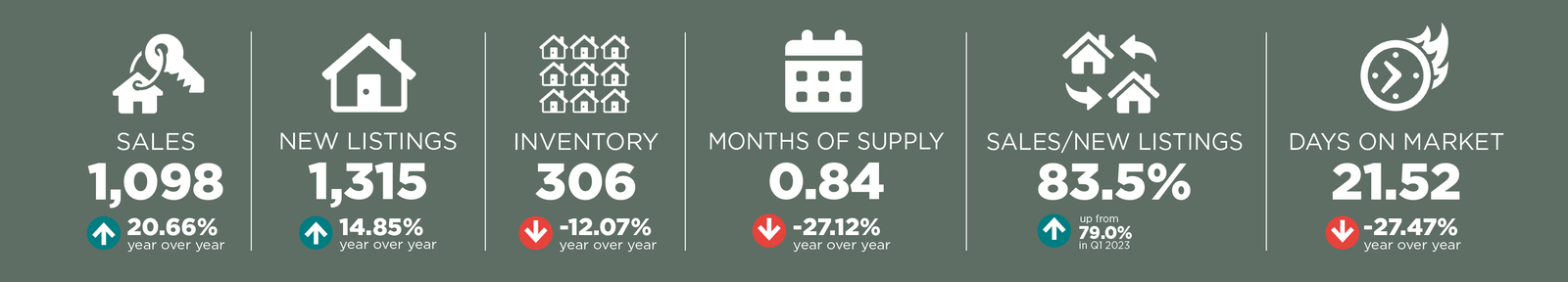

Row/Townhome

Row home/townhome prices reported the most significant gain of all property types as supply levels dwindled in the lower price ranges, driving sales growth in the upper price ranges. New listings did improve for properties priced above $400,000, but so did sales, preventing inventory improvements.

Source: CREB®

Apartment

Thanks to increased demand for affordable products, apartment sales reached a record high for the quarter, accounting for 30 percent of all resale activity. This increase was partly due to the growth in new listings. However, the gains in new listings did little to improve the overall inventory situation, and the months of supply dropped to just over one month—the lowest first-quarter levels seen since 2007.

Source: CREB®