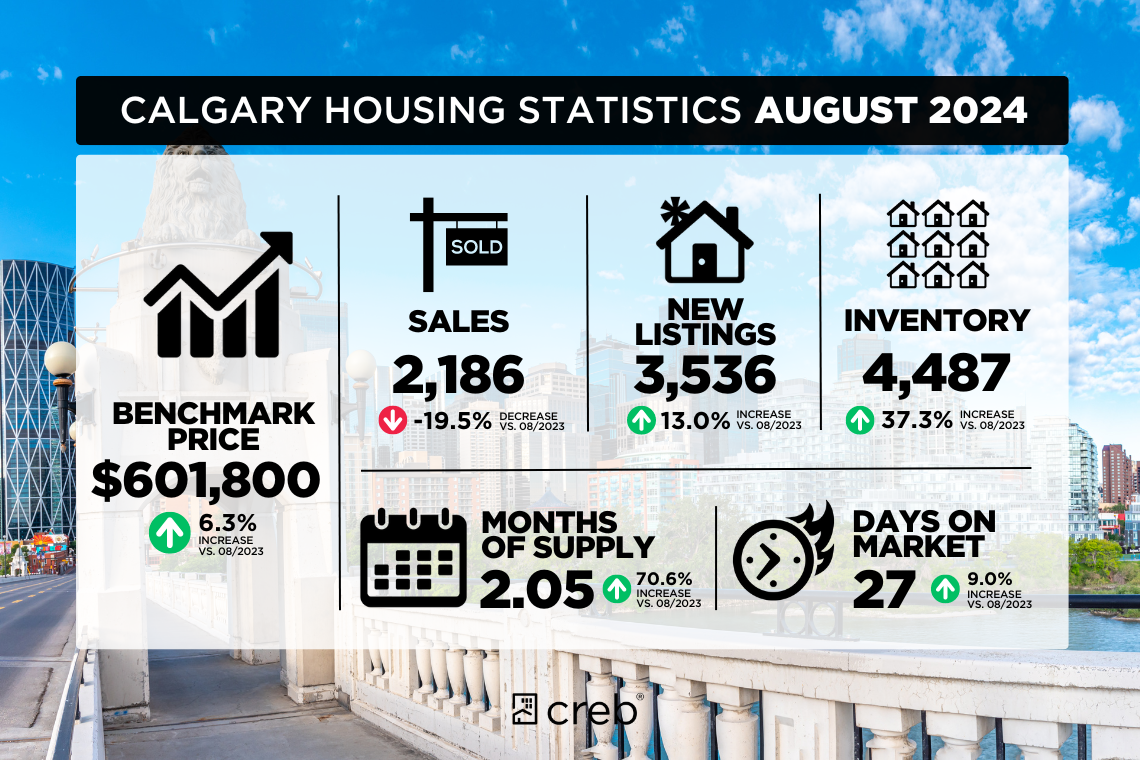

Housing activity continues to move away from the extreme sellers’ market conditions experienced throughout the spring. Easing sales, combined with gains in supply, pushed the months of supply above two months in August, a level not seen since the end of 2022.

“As expected, rising new home construction and gains in new listings are starting to support a better-supplied housing market,” said Ann-Marie Lurie, Chief Economist at CREB®. “This trend is expected to continue throughout the remainder of the year, but it’s important to note that supply levels remain low, especially for lower-priced properties. It will take time for supply levels to return to those that support more balanced conditions.”

Inventory levels in August reached 4,487 units, 37 percent higher than last August but nearly 25 percent lower than long-term trends for the month. Higher-priced properties mostly drove the supply gains, as the most affordable homes in each property type continued to report supply declines.

The supply gains were made possible by increased new listings in August and a pullback in sales activity. There were 2,186 sales in August, representing a 20 percent decline from last year's record high but still 17 percent higher than long-term averages for the month. The sales declines were driven by homes priced below $600,000.

Following stronger-than-expected gains earlier in the year, price growth is slowing. In August, the total unadjusted residential benchmark price was $601,800, six percent higher than last year and just slightly lower than last month. Year-to-date, the average benchmark price rose by nine percent.

Housing Market Facts

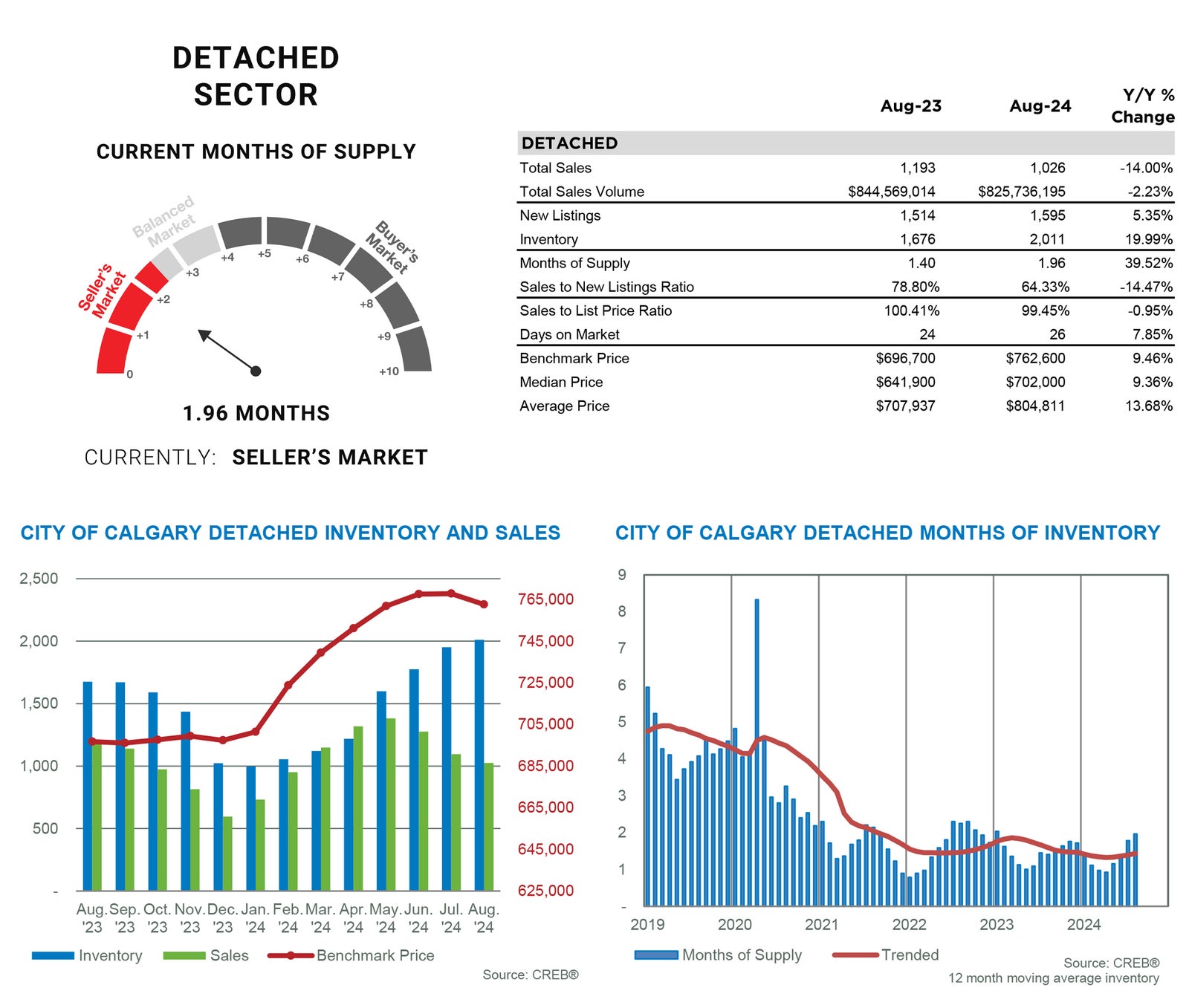

DETACHED

Detached home sales fell by 14 percent compared to last year, as gains in homes priced above $600,000 were not enough to offset declines in the lower price ranges, which continue to struggle with low supply levels. In August, 2,011 detached homes were available in inventory, with over 85 percent priced above $600,000.

The improvement in higher-end supply compared to sales helped push the supply months up to nearly two months. While market conditions are still tight, this significantly improved from the under-one-month supply experienced in the spring. Shifting conditions are relieving some pressure on home prices. In August, the unadjusted detached benchmark price was $762,600, slightly lower than last month but over nine percent higher than last year.

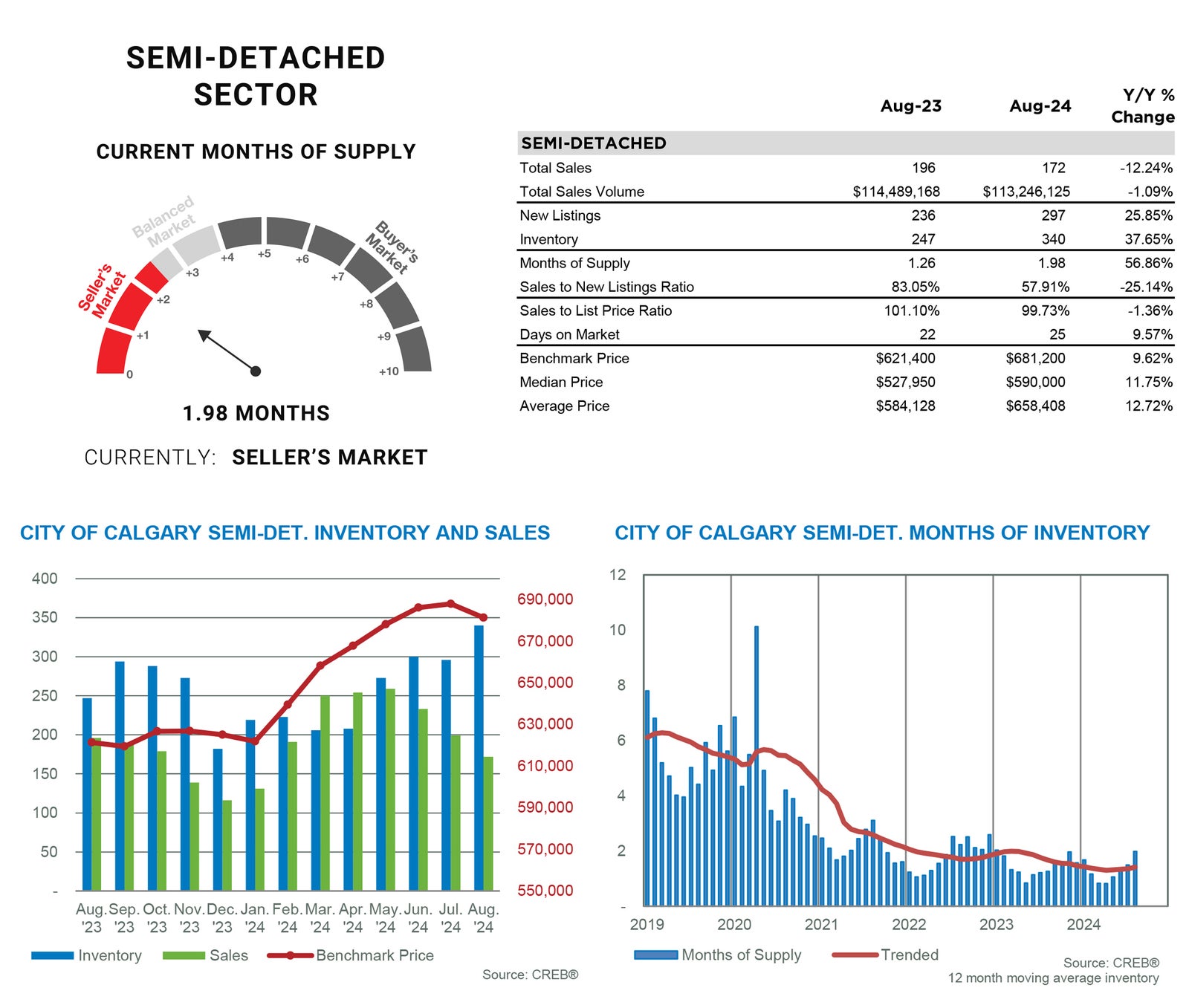

SEMI-DETACHED

With 297 new listings and 172 sales, the sales-to-new-listings ratio in August dropped to 58 percent, which is more consistent with pre-pandemic levels. This shift supported a rise in inventory levels, and the months of supply rose to nearly two months.

While conditions remain relatively tight, the boost in new listings has helped ease some of the pressure on prices. In August, the unadjusted benchmark price was $681,200, a decline from last month but nearly 10 percent higher than last year.

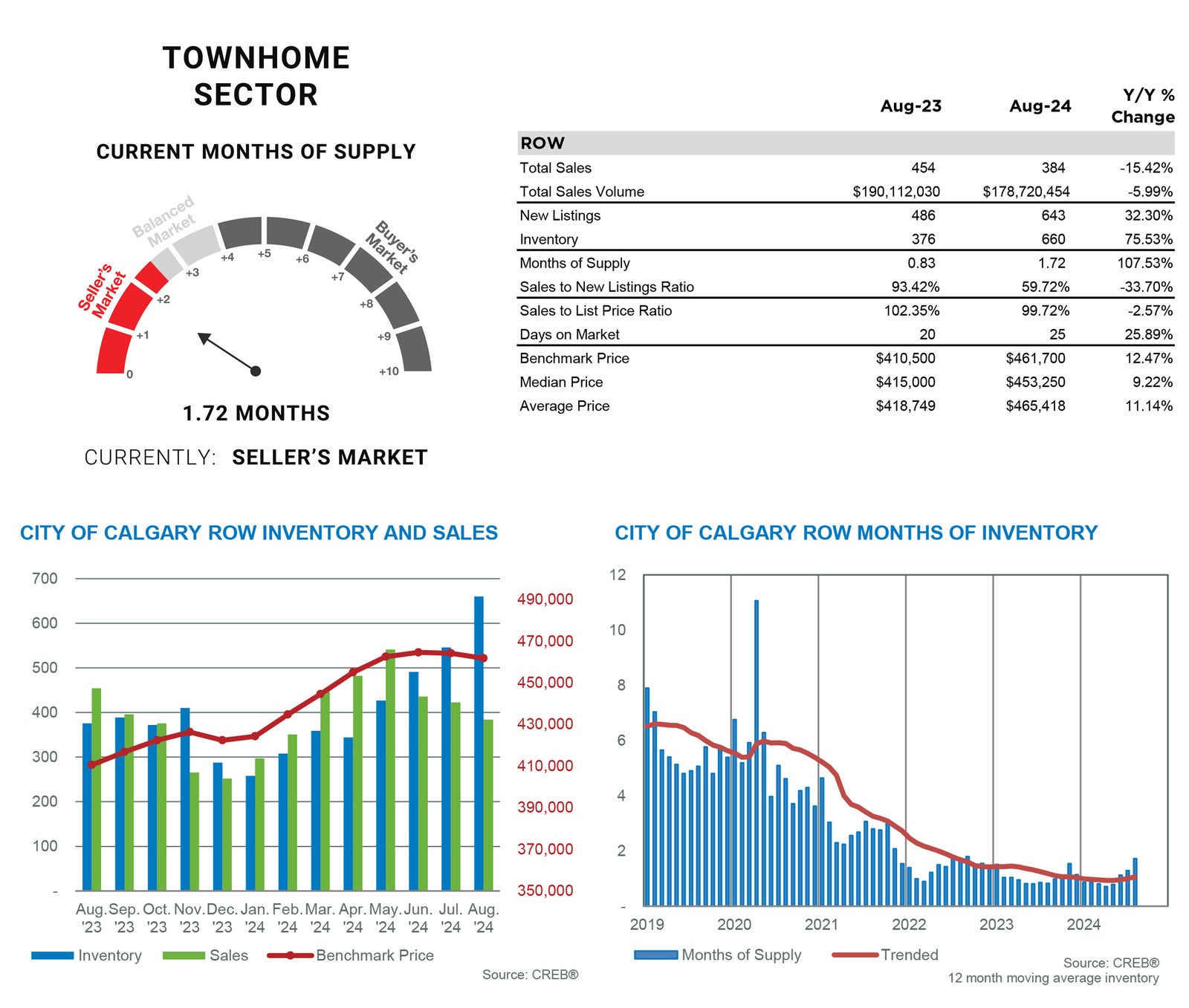

TOWNHOME/ROW

New listings row for homes priced above $400,000, contributing to year-to-date growth of nearly 16 percent. At the same time, slower sales over the past three months have contributed to inventory gains. In August, there were 660 units available, a 75 percent increase over the exceptionally low levels reported last year. While inventories are still low by historical standards, as with other property types, this shift is helping ease pressure on home prices.

The unadjusted benchmark price in August was $461,700, slightly lower than last month but over 12 percent higher than last August. Monthly adjustments were inconsistent across districts, with adjustments in the City Centre, North West, North, and West districts mostly driving monthly declines. Despite the monthly adjustments, year-over-year prices remain higher than last year across all districts, ranging from a low of 10 percent in the City Centre to a high of 26 percent in the East district.

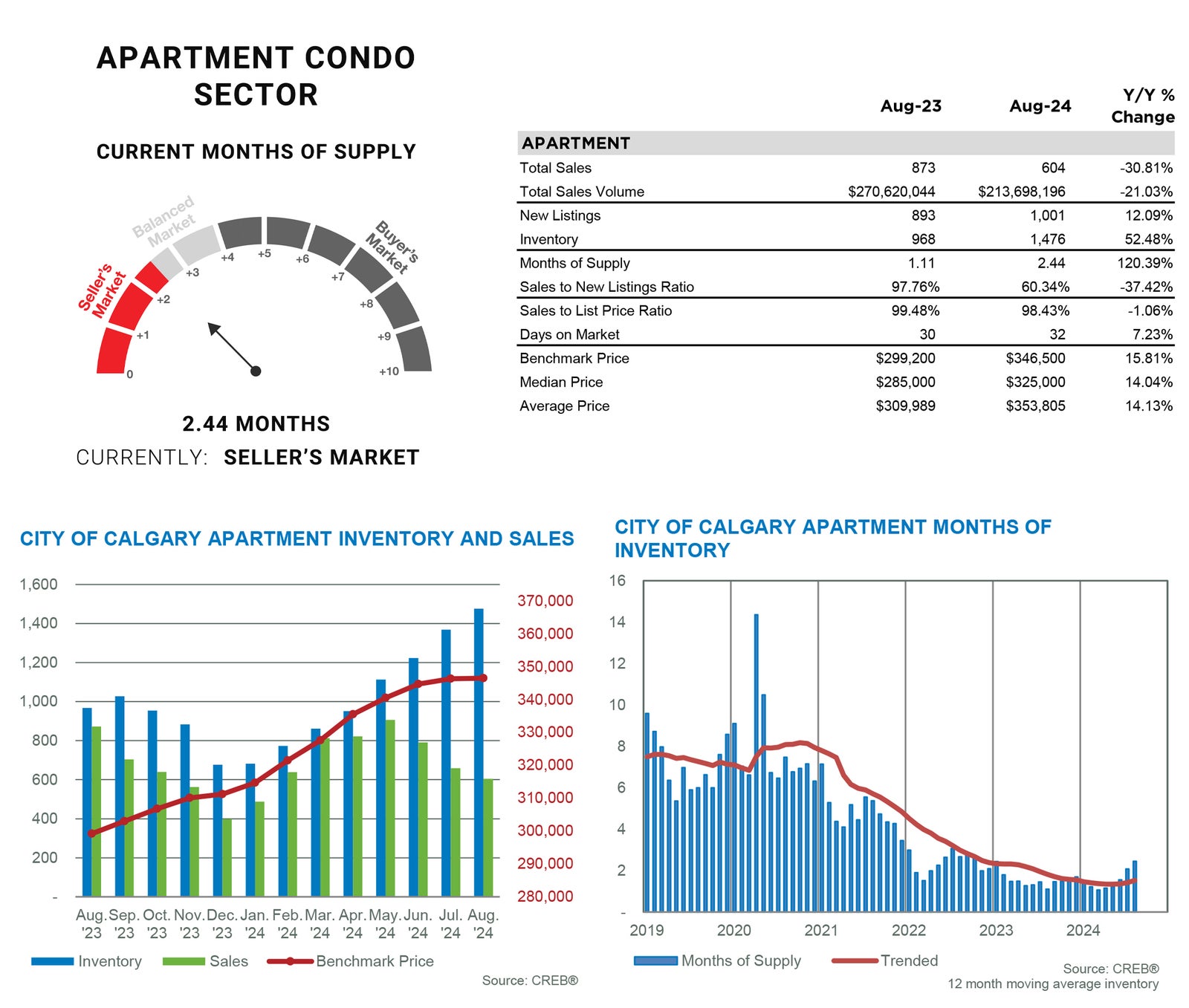

APARTMENT CONDO

New listings in August reached 1,001 units, a record high for the month. The gains in new listings were met with a pullback in sales, causing the sales-to-new-listings ratio to drop to 60 percent and inventories to rise to 1,476 units. Unlike other property types, overall condominium inventory levels were relatively consistent with longer-term trends for the month.

Rising inventory and easing sales caused the months of supply to increase to nearly two and a half months, not as high as levels seen before the pandemic but an improvement over the highly tight conditions seen over the past 18 months. In August, the unadjusted benchmark price was $346,500, similar to last month and nearly 16 percent higher than last year’s prices.