Rising sales in the upper price ranges were not enough to offset the pullback occurring in the lower price ranges, as sales in September were 2,003, 17 percent below last year's record high. Despite the decline, sales this month were still over 16 percent higher than levels traditionally achieved in September.

“We are starting to see a rise in new listings in our market. However, most of the listing growth is occurring in the higher price ranges,” said Ann-Marie Lurie, Chief Economist at CREB®. “While demand has stayed strong across all price ranges, the limited choice for lower-priced homes has likely prevented stronger sales in our market. While the challenges in the lower price ranges are not expected to change, improved supply combined with lower lending rates should keep demand strong throughout the fall, but without the extreme seller market conditions that contributed to the rapid price growth earlier this year.”

New listings in September rose to 3,687 units, the highest September total since 2008. This rise in new listings compared to sales did support some inventory growth. September inventory levels pushed up to 5,064 units, nearly double the exceptionally low levels reported in the spring, but remain below the 6,000 units we typically see in September.

Improving inventory levels compared to sales is continuing to shift our market toward more balanced conditions. In September, the months of supply reached 2.5 months. While this is a gain over last year’s record low, conditions are still tilted in favour of the seller.

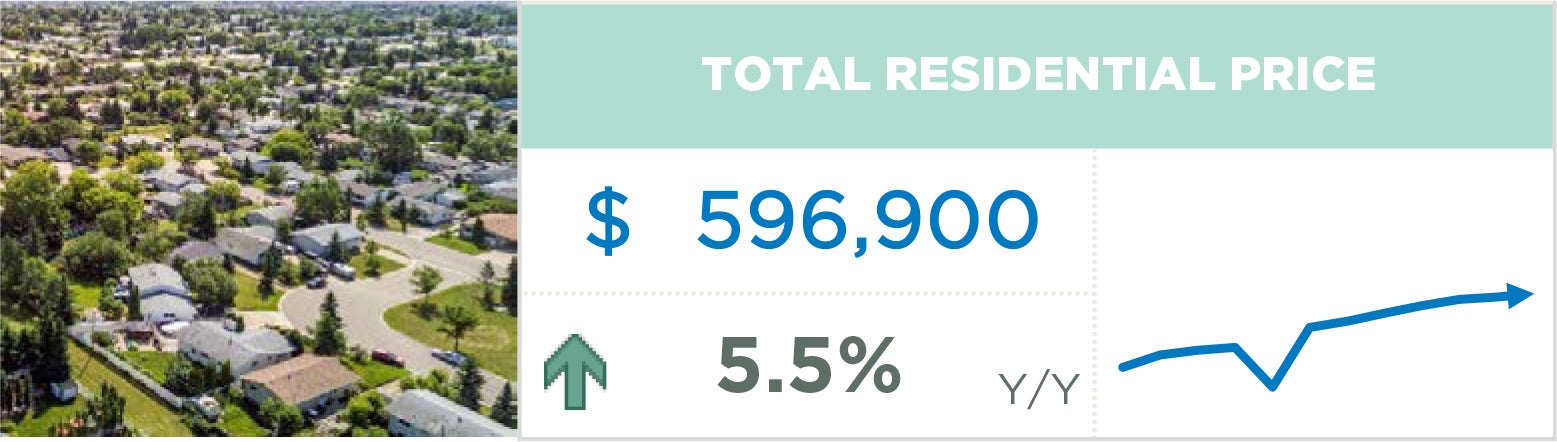

Additional supply in the market has taken some of the pressure off home prices over the past few months, following stronger-than-expected gains throughout the spring. In September, the unadjusted benchmark price was $596,900, slightly lower than last month but over five percent higher than last year’s levels. Year-over-year gains ranged from nearly nine percent growth for detached homes to nearly 14 percent gains in the apartment condominium market. The gains for each property type outpaced the growth in total residential prices, mostly due to the shifting composition of sales.

Housing Market Facts

DETACHED

The nine percent growth in sales over $700,000 was not enough to offset the steep pullbacks reported for homes priced below $600,000, causing September sales to total 942 units, a 17 percent decline over last year. Improved sales for higher-priced homes were possible thanks to rising new listings, as that segment of the market is starting to demonstrate more balanced conditions for homes priced above $700,000.

As of September, the unadjusted detached benchmark price was $757,100, a slight decline over last month but nearly nine percent higher than levels reported last year. It is not unusual to see some monthly adjustments in the fall, especially following stronger gains in the spring. With tighter conditions being experienced for lower-priced products, price growth has also ranged within the detached sector. The North East and East districts continue to report the largest year-over-year price gains.

SEMI-DETACHED

September reported 299 new listings and 182 sales, causing the sales-to-new listings ratio to trend up over last month to nearly 61 percent. Despite the gain over the past several months, the improvements in new listings relative to sales have supported rising inventory levels. However, with less than 400 units available, inventory levels remain nearly 33 percent below long-term trends for September.

Like the other property types, recent gains in new listings are causing the months of supply to improve over last year's levels. However, with just over two months of supply in September, conditions continue to favour the seller. Following strong gains in the spring, in September, the unadjusted benchmark price eased slightly over last month, but at a price of $678,400, levels are over nine percent higher than last year at this time.

TOWNHOME/ROW

Over 600 new listings came onto the market in September, where over 70 percent of the new listings were priced above $400,000. While new listings improved across most districts, 34 percent of the new listings were in the North and South districts, likely a reflection of the new home activity occurring in those areas. Sales in September totalled 377 units, slightly lower than last year's levels.

Inventories in September rose to 747 units, a significant improvement over the previous two years, but still below long-term trends. Nonetheless, the rise in inventory relative to sales did cause the months of supply to increase to nearly two months. Conditions continue to favour the seller, but improved choice did slow the pace of price growth. The unadjusted benchmark price in September was $459,200, 10 percent higher than September 2023 levels.

APARTMENT

Strong gains in new listings continued into September, with 993 units entering the market. At the same time, sales dropped to 502 units, causing the sales-to-new listings ratio to drop to 50 percent and inventories to rise to 1,623 units. Of the inventory in the market, over 72 percent was priced above $300,000, a significant shift compared to last year, where less than 58 percent of the listings were above that range.

Gain in supply compared to sales caused the months of supply to rise to 3.2 months, the highest level seen since the end of 2021. Improving supply in the new home market is likely contributing to the rise in supply and has taken some of the pressure off home prices. In September, the unadjusted benchmark price was $345,000, 14 percent higher than last year at this time. Year-to-date prices are still averaging a year-over-year gain of 17 percent.