As we transition into winter, Calgary's housing market is following typical seasonal trends, with activity slowing compared to the fall. However, year-over-year demand remains relatively strong. In November, increased sales in detached, semi-detached, and row homes offset a decline in apartment condominium sales. The 1,797 sales for November mirrored last year’s levels and remained 20 percent above long-term trends for the month.

The significant shift lies in supply. Inventory levels rose to 4,352 units in November, a notable increase from the 3,000 units reported last year. Despite the recent gains, inventory levels remain below long-term trends for the month.

“Housing supply has been a challenge over the past several years due to the sudden rise in population,” said Ann-Marie Lurie, Chief Economist at CREB®. “Rising new home construction has bolstered supply in rental, new home and resales ownership markets. However, supply improvements vary significantly by location, price range, and property type.”

The months of supply have increased to over two months, representing a shift away from the extremely low levels seen earlier this year and in the past three Novembers, which reported under two months of supply. While these more balanced conditions are promising for potential buyers, many market segments still favour sellers.

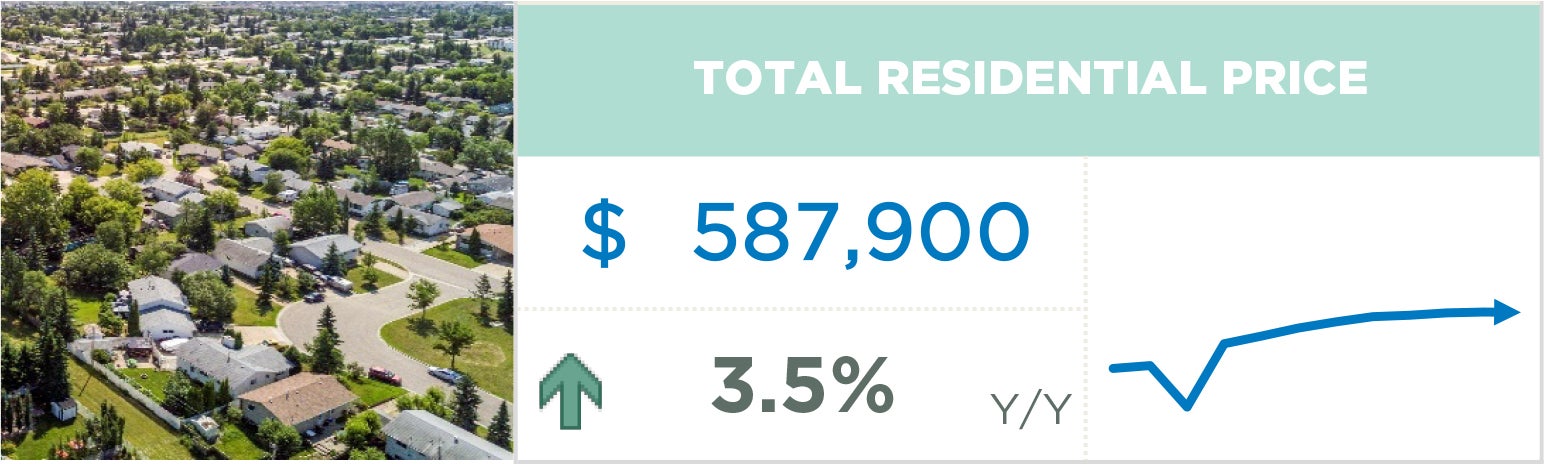

Improved supply options have tempered the pace of price growth. Year-over-year gains range from nearly seven percent for row homes to nine percent for apartment-style units. The total residential benchmark price reached $587,900, reflecting a year-over-year increase of just under four percent. This slower growth reflects a shift toward more affordable row and apartment-style units. Seasonally adjusted prices have remained stable over the past four months despite unadjusted prices trending down in line with seasonal patterns.

Housing Market Facts

DETACHED

Rising sales for homes above $600,000 offset the declines in the lower price ranges caused by limited supply choice. While inventory levels did improve, 85 percent of the supply was priced above $600,000. Improving supply caused the months of supply to push above two months in November, with higher months of supply reported for homes priced above $700,000 and less than two months of supply for homes priced below that level. This variation within the market is likely to result in different price pressures.

The unadjusted detached benchmark price was $750,100, slightly lower than last month but over seven percent higher than prices reported last year at this time. Year-over-year gains have ranged across the city, with slower growth reported in areas with the most competition from newer homes.

SEMI-DETACHED

There were 173 sales in November, an improvement over last year and contributing to the year-to-date growth of nearly five percent. This was possible thanks to gains in new listings and higher supply levels. With two months of supply, conditions are not as tight as earlier in the year but still favour the seller, especially for properties priced below $700,000.

As of November, the unadjusted benchmark price was $675,100, nearly eight percent higher than last November. The pace of price growth has eased over the past several months, primarily due to seasonal factors. Benchmark prices ranged from $926,800 in the City Centre district to $409,300 in the East district of the city.

TOWNHOME/ROW

Row home sales improved in November compared to last year, contributing to nearly three percent of year-to-date gains. Sales have remained exceptionally strong over the past three years as purchasers seek more affordable options. At the same time, new listings have also improved relative to sales, supporting year-over-year gains in inventory levels. Despite inventory improvements, conditions remained relatively tight with nearly two months of supply.

Following steep gains earlier in the year, the pace of price growth has eased. As of November, the unadjusted benchmark price was $454,200, nearly seven percent higher than last year. Year-to-date average benchmark prices have improved by nearly 15 percent. Row prices in the City Centre were the highest at $620,000, while the North East and East districts were the only areas to report benchmark prices below $400,000.

APARTMENT CONDO

Sales in November slowed over last year's record high. However, the 429 sales were still 47 percent higher than long-term trends. New listings for apartment-style units have been on the rise. With 1,482 units available in November, more supply is available now than during the spring, and it is the only sector to see levels rise above long-term trends for the month.

The additional supply has caused the months of supply to push above three months and is taking some of the pressure off home prices. As of November, the unadjusted benchmark price was $337,800, down over last month but still nine percent higher than last year. Supply has improved for units priced above $200,000, but most gains have been in the $300,000 to $500,000 range.