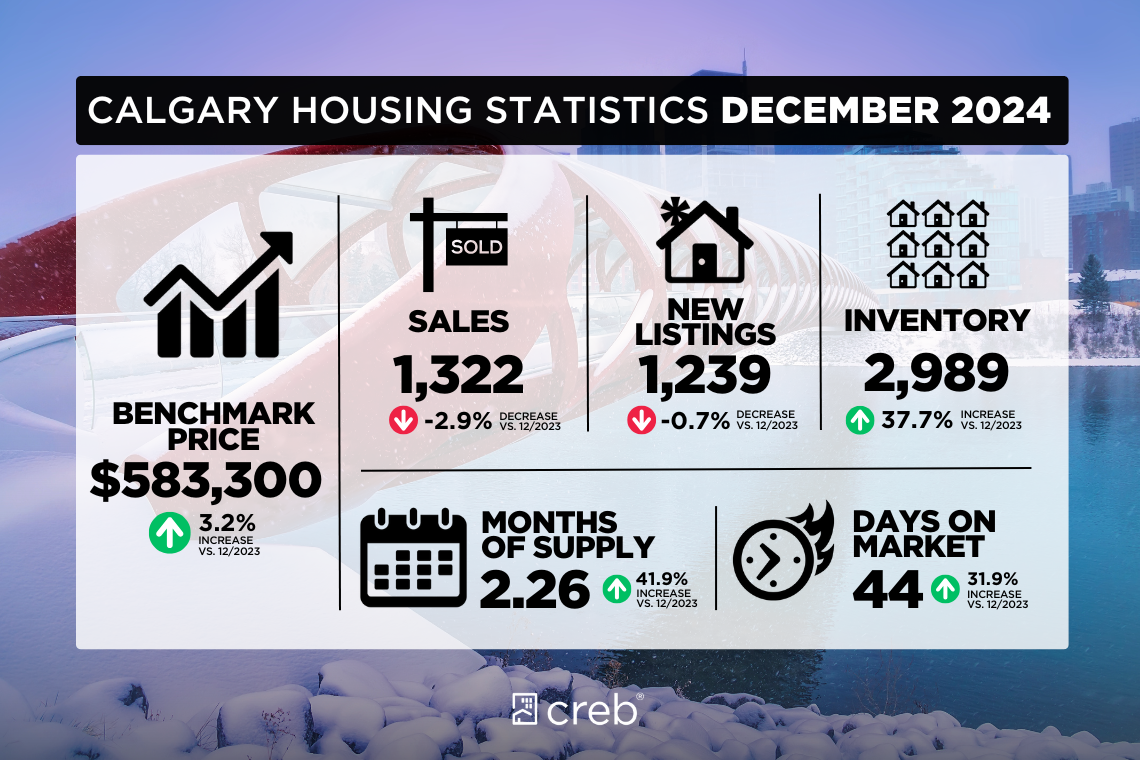

The year ended with 1,322 sales in December, a three percent decline over last year, but nearly 20 percent higher than long-term trends. Overall sales in 2024 were just shy of last year’s levels, as gains for higher-priced homes offset pullbacks in the lower price ranges caused by supply challenges.

“Population gains over the past several years have supported sales activity that has outperformed long-term trends. In 2024, sales would likely have been higher if there was more supply choice, especially in the lower price ranges,” said Ann-Marie Lurie, Chief Economist at CREB®. “That being said, we did start to see shifts occurring in the market in the second half of the year as supply levels started to improve for higher priced homes.”

As of December, there were 2,989 units available in inventory, still below long-term trends for the month but a significant improvement over the lower levels reported last December and levels reported early this year. Improved rental choice and significant gains in new home activity helped boost new listings in the resale market, driving higher inventories in the year's second half.

While conditions vary depending on price range and property type, more housing options have helped to take some of the pressure off home prices, which stabilized in the second half of the year following steep gains in the spring. Overall, on an annual basis, total residential benchmark prices improved by over seven percent.

As we move into 2025, supply will continue to be a dominant theme. However, how they impact prices will ultimately depend on the type of supply being added and how demand holds up in the face of a changing economic climate. On January 21, CREB® will release its forecast report, highlighting the expectations and risks facing the market in the coming year.

Housing Market Facts

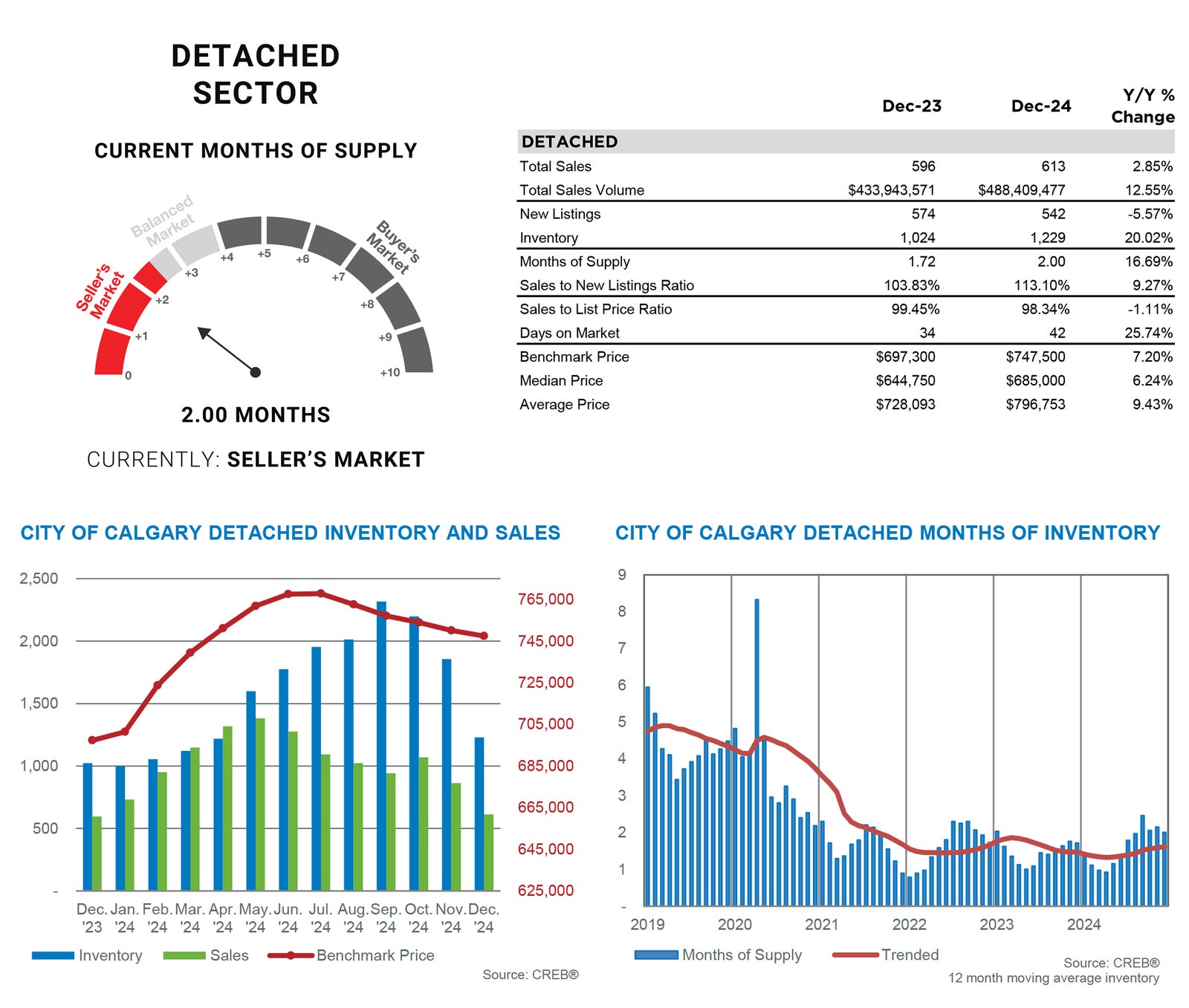

DETACHED

Easing lending rates have likely supported some recent year-over-year gains in detached home sales over the past three months. Improving sales were driven by gains for homes over $600,000, which also reported improvements in new listings. Inventory levels did improve within city limits for detached homes; however, conditions varied across districts. The City Centre, North East and North District all reported relatively balanced conditions over the last quarter of the year, while all other districts continued to struggle with seller market conditions.

The relatively tight market conditions throughout the year caused prices to rise by nearly eleven percent in 2024, a faster pace than what was reported in 2023. Much of that growth occurred during spring when supply levels were exceptionally low. Prices grew across all districts, with the strongest growth occurring in the most affordable districts of the North East and East.

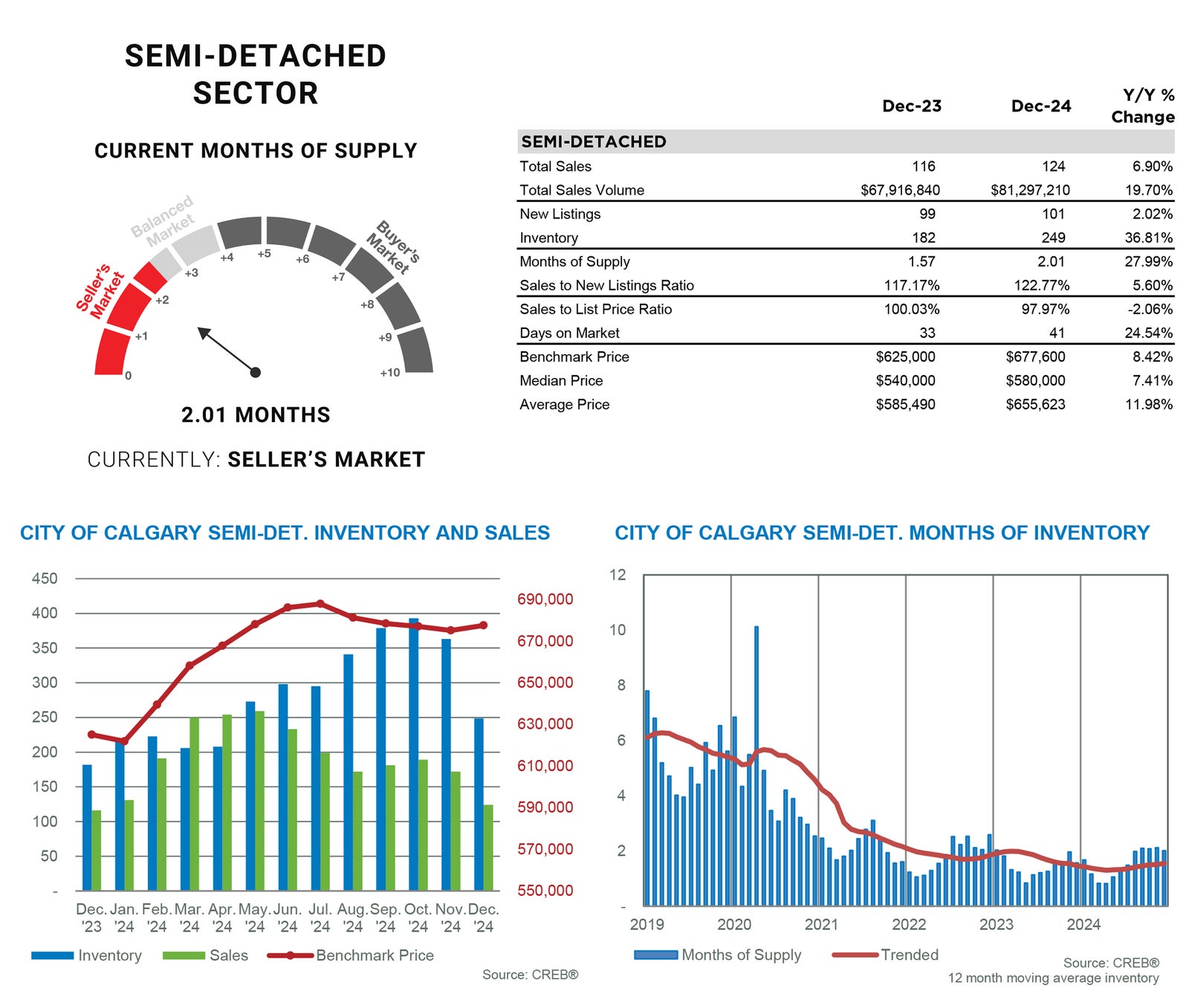

SEMI-DETACHED

Limited supply choice for lower-priced detached homes drove many purchasers toward the semi-detached sector. In 2024, there were 2,355 sales, with an annual gain of five percent. Thanks to gains in new listings relative to sales, inventory levels started to improve, supporting a shift toward more balanced conditions by the fourth quarter. However, much of this shift occurred in the higher-priced City Centre district, where the months of supply averaged three months in the last quarter.

The annual average benchmark price increased by nearly 11 percent to $669,042 in 2024. Like detached homes, exceptionally tight conditions throughout the spring caused the pace of price growth to rise over the seven percent annual gain reported in 2023. Prices improved across all districts, ranging from an annual gain of under 10 percent in the City Centre and West to gains exceeding 15 percent in the North East and East districts.

TOWNHOME/ROW

In 2024, there were 4,647 row home sales, a gain of over two percent compared to last year and the second-highest total on record. The growth in sales was possible thanks to the 18 percent gain in new listings, most of which occurred for homes priced above $400,000—the gains in new listings relative to sales supported inventory growth in 2024.

By the year's end, supply improvements helped take the pressure off home prices. However, the annual benchmark price rose by 14 percent as conditions favoured the seller throughout the year. Prices rose across all districts in the city, with the gains ranging from a low of 12 percent in the city centre to over 20 percent in the most affordable districts in the North East and East.

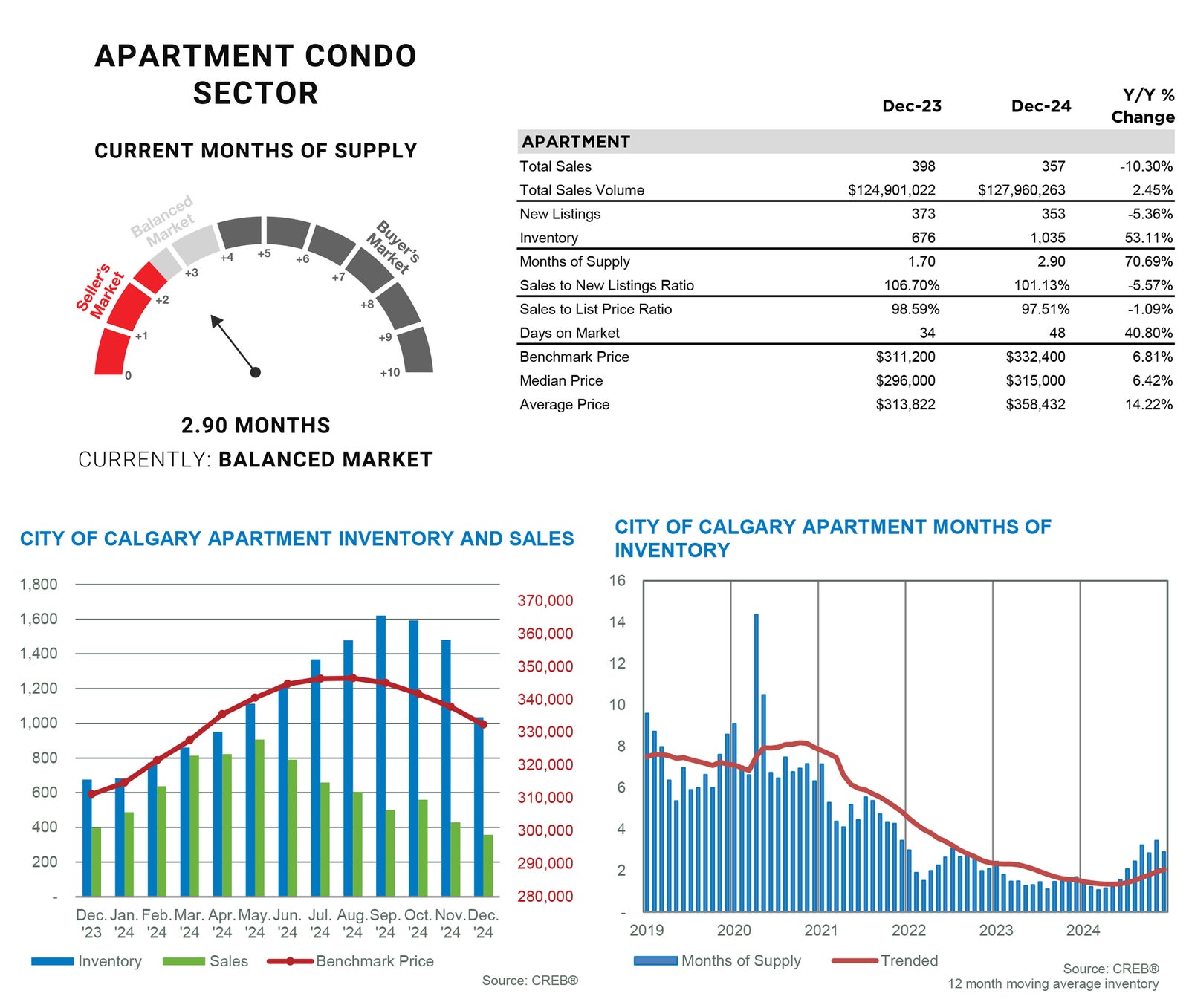

APARTMENT CONDO

Easing sales in the second half of the year offset earlier gains, causing apartment sales to slow by four percent compared to last year. However, last year was a record high for sales, and the 7,568 transactions this year reflect the second-highest year on record. At the same time, new listings have been on the rise, supporting inventory gains and a shift toward more balanced conditions by the end of the year.

As more supply became available, we did see some price adjustments in the last quarter of the year. However, the quarterly decline did not offset the strong gains that occurred earlier in the year, and the annual benchmark price rose by 15 percent. Price growth ranged from a low of 11 percent in the city centre to over twenty percent in the North East, East and South districts.